pacman::p_load(knitr,

tidyverse,

patchwork,

ggdist,

ggtext,

ggrepel,

scales)Take-home Exercise 1: Singapore Private Residential Property Market for 2024 Q1

1 Overview

1.1 Background

Singapore has one of the highest home ownership rates in the world at 89.7%, 2nd only to Russia among the G20 countries. Due to Singapore’s successful public housing program, 77.8% of Singapore residents live in HDB flats, while 22% live in private properties like condos or landed properties.

While the HDB market targets Singaporeans with household income of up to 14,000 SGD, the private housing market is Singapore is still in demand for households looking to upgrade, invest their property, and for residents not eligible for public housing (e.g. high income household, foreigners, etc.)

In this exercise we will look at the market trends for private residential property market for 2024 Q1 and see how the economic factors have affected it.

1.2 Loading the data sources

For this exercise, we will use the residential real estate transaction data from REALIS. This provides comprehensive and up-to-date statistics on the private property market in Singapore.

The dataset has been provided via eLearn and added to the data/ folder of this exercise.

For the purposes of this exercise, we will refer to each data as the following:

2023Q1:

ResidentialTransaction20240308160536.csv2023Q2:

ResidentialTransaction20240308160736.csv2023Q3:

ResidentialTransaction20240308161009.csv2023Q4:

ResidentialTransaction20240308161109.csv2024Q1:

ResidentialTransaction20240414220633.csv

1.3 Methodology

To start the data analysis, we first need to prepare the R environment for analysis. This includes loading the R packages and loading the datasets.

After the setup, we need to do data wrangling where we clean and transform the data into a form that is fitting for our analysis. This will possible entail removing irrelevant data, deriving additional variables, renaming columns, etc.

As part of wrangling, we need to decide on what data we would like to look at closely. For the purposes of this exercise, these are the data we can look at that can potentially give valuable insights:

Total units sold by quarter

Units sold by submarkets such as property type (e.g. condominium, terrace house, apartment, detached house), sale type (e.g. resale, new sale, subsale), etc.

Transaction price by submarkets such property type (e.g. condominium, terrace house, apartment, detached house, etc), sale type (e.g. resale, new sale, subsale), etc.

Finally, we will do data exploration and visualize the insights gained from the data. Some of the questions we would ask are:

What is the general trend of private residential property sales prices?

Is this trend consistent among all submarkets?

How affordable are private residential properties for Singaporean households?

2 Setup

2.1 Loading the R packages

For this exercise, we will mainly use the following packages for data analysis:

- tidyverse: A collection of R packages used in data science, which includes ggplot2, tibble, readr, among others

- ggdist: Provides functions for presenting distributions in

ggplot2.stat_halfeye()andstat_dots()will be used the most. - ggtext: Enhances text rendering for

ggplot2.element_markdown()is most notable function used for markdown rendering so we can highlight important information in text. - ggrepel: Manages overlapping texts and labels on

ggplot2. We will use this to render labels on dense plots. - patchwork: Allows composition of multiple graphs into a single plot

Aside from these, we will also include other packages that will help us present the data better.

- knitr: Provides tools for dynamic report generation in R. For this exercise, we will use this package to render our tables better.

- scales: Extends functions to operate on

ggplot2scales. For this exercise, we will usewrap_format()to wrap long texts.

2.2 Data Checkpoints

As the analysis is expected to have a lot of intermediate steps, Save, Load, and Data clear points are available to make our data wrangling more efficient.

This is where data is written as rds files using write_rds() for important data sets that will be used in later analysis. Examples are:

- Data we need to prepare for analysis

- Critical outputs of expensive calculations

- Cleaned up data for lightweight processing

This is where data is loaded from rds files using read_rds(). They were previously generated by the save point.

TIP: Skip to the load points to progress without running the code above it

This is where data that will not be used anymore are cleared. The data in RStudio environment will pile up and will make it more difficult to check the relevant data in each part.

We can set #| eval: false in code chunks if we want skip the clearing. For example, the code below won’t be run.

message <- "This code chunk executed"To use these checkpoints, we need to create data/rds folder.

3 Data Wrangling

3.1 Importing the datasets

Upon inspection of the csv files, column names have human-readable titles such as “Project Name”, “Transacted Price ($)”, etc. While good for humans, these column names may cause parsing issues with R, especially as there are special characters.

Because of this, we will rename the columns in their UPPER_CASE format after removing the special characters. We will create a helper function that will help us accomplish this:

rename_realis_column <- function(orig_name) {

# Add underscores to spaces

gsub(" +", "_",

# Remove special characters

gsub("[^A-Z ]", "",

# Convert to upper case and remove trailing spaces

toupper(orig_name)) %>% trimws())

}We will use read_csv() to import each file and use rename_realis_column() in the rename_with() function.

realis_2023q1 <- read_csv('data/ResidentialTransaction20240308160536.csv') %>%

rename_with(rename_realis_column)

kable(head(realis_2023q1, n=7))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| THE REEF AT KING’S DOCK | 2317000 | 882.65 | 2625 | 01 Jan 2023 | 12 HARBOURFRONT AVENUE #05-32 | New Sale | Strata | 82.0 | 28256 | - | Condominium | 1 | 99 yrs from 12/01/2021 | Uncompleted | HDB | 097996 | 04 | 09 | Central Region | Bukit Merah |

| URBAN TREASURES | 1823500 | 882.65 | 2066 | 02 Jan 2023 | 205 JALAN EUNOS #08-02 | New Sale | Strata | 82.0 | 22238 | - | Condominium | 1 | Freehold | Uncompleted | Private | 419535 | 14 | 41 | East Region | Bedok |

| NORTH GAIA | 1421112 | 1076.40 | 1320 | 02 Jan 2023 | 29 YISHUN CLOSE #08-10 | New Sale | Strata | 100.0 | 14211 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 269343 | 27 | 26 | North Region | Yishun |

| NORTH GAIA | 1258112 | 1033.34 | 1218 | 02 Jan 2023 | 45 YISHUN CLOSE #07-42 | New Sale | Strata | 96.0 | 13105 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 269294 | 27 | 26 | North Region | Yishun |

| PARC BOTANNIA | 1280000 | 871.88 | 1468 | 03 Jan 2023 | 12 FERNVALE STREET #06-16 | Resale | Strata | 81.0 | 15802 | - | Condominium | 1 | 99 yrs from 28/12/2016 | 2022 | HDB | 797391 | 28 | 79 | North East Region | Sengkang |

| NANYANG PARK | 5870000 | 3322.85 | 1767 | 03 Jan 2023 | 72 JALAN LIMBOK | Resale | Land | 308.7 | 19015 | - | Terrace House | 1 | 999 yrs from 14/02/1881 | - | Private | 548742 | 19 | 54 | North East Region | Hougang |

| PALMS @ SIXTH AVENUE | 4950000 | 4520.88 | 1095 | 03 Jan 2023 | 231 SIXTH AVENUE | Resale | Strata | 420.0 | 11786 | - | Semi-Detached House | 1 | Freehold | 2015 | Private | 275780 | 10 | 27 | Central Region | Bukit Timah |

There are 4,722 private residential propertysales for 2023 Q1.

realis_2023q2 <- read_csv('data/ResidentialTransaction20240308160736.csv') %>%

rename_with(rename_realis_column)

kable(head(realis_2023q2, n=7))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| THE GAZANIA | 1528000 | 678.13 | 2253 | 01 Apr 2023 | 15 HOW SUN DRIVE #02-31 | New Sale | Strata | 63 | 24254 | - | Condominium | 1 | Freehold | 2022 | N.A | 538545 | 19 | 53 | North East Region | Serangoon |

| THE GAZANIA | 1938000 | 958.00 | 2023 | 01 Apr 2023 | 7 HOW SUN DRIVE #01-12 | New Sale | Strata | 89 | 21775 | - | Condominium | 1 | Freehold | 2022 | Private | 538530 | 19 | 53 | North East Region | Serangoon |

| ONE PEARL BANK | 2051000 | 699.66 | 2931 | 01 Apr 2023 | 1 PEARL BANK #32-16 | New Sale | Strata | 65 | 31554 | - | Apartment | 1 | 99 yrs from 01/03/2019 | Uncompleted | Private | 169016 | 03 | 16 | Central Region | Outram |

| URBAN TREASURES | 1850700 | 882.65 | 2097 | 01 Apr 2023 | 205 JALAN EUNOS #05-05 | New Sale | Strata | 82 | 22570 | - | Condominium | 1 | Freehold | Uncompleted | HDB | 419535 | 14 | 41 | East Region | Bedok |

| HYLL ON HOLLAND | 2021500 | 699.66 | 2889 | 01 Apr 2023 | 97 HOLLAND ROAD #10-25 | New Sale | Strata | 65 | 31100 | - | Condominium | 1 | Freehold | Uncompleted | Private | 278541 | 10 | 27 | Central Region | Bukit Timah |

| LEEDON GREEN | 1838000 | 785.77 | 2339 | 01 Apr 2023 | 34 LEEDON HEIGHTS #12-40 | New Sale | Strata | 73 | 25178 | - | Condominium | 1 | Freehold | Uncompleted | Private | 266076 | 10 | 26 | Central Region | Bukit Timah |

| KLIMT CAIRNHILL | 7320000 | 2055.92 | 3560 | 01 Apr 2023 | 71 CAIRNHILL ROAD #15-01 | New Sale | Strata | 191 | 38325 | - | Apartment | 1 | Freehold | Uncompleted | Private | 229725 | 09 | 22 | Central Region | Newton |

There are 6,125 private residential property sales for 2023 Q2.

realis_2023q3 <- read_csv('data/ResidentialTransaction20240308161009.csv') %>%

rename_with(rename_realis_column)

kable(head(realis_2023q3, n=7))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MYRA | 1658000 | 667.37 | 2484 | 01 Jul 2023 | 9 MEYAPPA CHETTIAR ROAD #02-07 | New Sale | Strata | 62 | 26742 | - | Apartment | 1 | Freehold | Uncompleted | N.A | 358456 | 13 | 35 | Central Region | Toa Payoh |

| NORTH GAIA | 1449000 | 1076.40 | 1346 | 01 Jul 2023 | 27 YISHUN CLOSE #10-06 | New Sale | Strata | 100 | 14490 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 769342 | 27 | 76 | North Region | Yishun |

| NORTH GAIA | 1365000 | 1076.40 | 1268 | 01 Jul 2023 | 27 YISHUN CLOSE #05-06 | New Sale | Strata | 100 | 13650 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 769342 | 27 | 76 | North Region | Yishun |

| NORTH GAIA | 1231000 | 958.00 | 1285 | 01 Jul 2023 | 35 YISHUN CLOSE #08-25 | New Sale | Strata | 89 | 13831 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 769299 | 27 | 76 | North Region | Yishun |

| NORTH GAIA | 1272000 | 1001.05 | 1271 | 01 Jul 2023 | 45 YISHUN CLOSE #09-45 | New Sale | Strata | 93 | 13677 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 769294 | 27 | 76 | North Region | Yishun |

| PICCADILLY GRAND | 3462000 | 1679.18 | 2062 | 01 Jul 2023 | 3 NORTHUMBERLAND ROAD #14-09 | New Sale | Strata | 156 | 22192 | - | Apartment | 1 | 99 yrs from 02/08/2021 | Uncompleted | Private | 219569 | 08 | 21 | Central Region | Kallang |

| TENET | 1356000 | 925.70 | 1465 | 01 Jul 2023 | 71 TAMPINES STREET 62 #14-02 | New Sale | Strata | 86 | 15767 | - | Executive Condominium | 1 | 99 yrs from 01/11/2021 | Uncompleted | HDB | 529699 | 18 | 52 | East Region | Tampines |

There are 6,206 private residential property sales for 2023 Q3.

realis_2023q4 <- read_csv('data/ResidentialTransaction20240308161109.csv') %>%

rename_with(rename_realis_column)

kable(head(realis_2023q4, n=7))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LEEDON GREEN | 1749000 | 538.20 | 3250 | 01 Oct 2023 | 26 LEEDON HEIGHTS #11-08 | New Sale | Strata | 50 | 34980 | - | Condominium | 1 | Freehold | Uncompleted | Private | 266221 | 10 | 26 | Central Region | Bukit Timah |

| LIV @ MB | 3148740 | 1453.14 | 2167 | 01 Oct 2023 | 114A ARTHUR ROAD #01-01 | New Sale | Strata | 135 | 23324 | - | Condominium | 1 | 99 yrs from 23/11/2021 | Uncompleted | Private | 439826 | 15 | 43 | Central Region | Marine Parade |

| MORI | 2422337 | 1259.39 | 1923 | 01 Oct 2023 | 223 GUILLEMARD ROAD #05-21 | New Sale | Strata | 117 | 20704 | - | Apartment | 1 | Freehold | Uncompleted | Private | 399738 | 14 | 39 | Central Region | Geylang |

| THE ARDEN | 1330000 | 721.19 | 1844 | 01 Oct 2023 | 6 PHOENIX ROAD #01-18 | New Sale | Strata | 67 | 19851 | - | Apartment | 1 | 99 yrs from 14/07/2023 | Uncompleted | Private | 668159 | 23 | 66 | West Region | Bukit Batok |

| LENTOR MODERN | 2237000 | 1130.22 | 1979 | 01 Oct 2023 | 3 LENTOR CENTRAL #05-03 | New Sale | Strata | 105 | 21305 | - | Apartment | 1 | 99 yrs from 26/10/2021 | Uncompleted | Private | 788888 | 26 | 78 | North East Region | Ang Mo Kio |

| THE LAKEGARDEN RESIDENCES | 1249900 | 592.02 | 2111 | 01 Oct 2023 | 82 YUAN CHING ROAD #04-14 | New Sale | Strata | 55 | 22725 | - | Condominium | 1 | 99 yrs from 31/05/2023 | Uncompleted | HDB | 619614 | 22 | 61 | West Region | Jurong East |

| LENTOR HILLS RESIDENCES | 2890000 | 1356.26 | 2131 | 01 Oct 2023 | 31 LENTOR HILLS ROAD #15-03 | New Sale | Strata | 126 | 22937 | - | Apartment | 1 | 99 yrs from 25/04/2022 | Uncompleted | HDB | 788881 | 26 | 78 | North East Region | Ang Mo Kio |

There are 4,851 private residential property sales for 2023 Q4.

realis_2024q1 <- read_csv('data/ResidentialTransaction20240414220633.csv') %>%

rename_with(rename_realis_column)

kable(head(realis_2024q1, n=7))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| THE LANDMARK | 2726888 | 1076.40 | 2533 | 01 Jan 2024 | 173 CHIN SWEE ROAD #22-11 | New Sale | Strata | 100 | 27269 | - | Condominium | 1 | 99 yrs from 28/08/2020 | Uncompleted | Private | 169878 | 03 | 16 | Central Region | Outram |

| POLLEN COLLECTION | 3850000 | 1808.35 | 2129 | 01 Jan 2024 | 34 POLLEN PLACE | New Sale | Land | 168 | 22917 | - | Terrace House | 1 | 99 yrs from 09/12/2019 | Uncompleted | N.A | 807233 | 28 | 80 | North East Region | Serangoon |

| SKY EDEN@BEDOK | 2346000 | 1087.16 | 2158 | 01 Jan 2024 | 1 BEDOK CENTRAL #09-10 | New Sale | Strata | 101 | 23228 | - | Apartment | 1 | 99 yrs from 05/01/2022 | Uncompleted | HDB | 469657 | 16 | 46 | East Region | Bedok |

| TERRA HILL | 2190000 | 807.30 | 2713 | 01 Jan 2024 | 18A YEW SIANG ROAD #03-12 | New Sale | Strata | 75 | 29200 | - | Apartment | 1 | Freehold | Uncompleted | N.A | 118992 | 05 | 11 | Central Region | Queenstown |

| PINETREE HILL | 1954000 | 796.54 | 2453 | 01 Jan 2024 | 36 PINE GROVE #05-18 | New Sale | Strata | 74 | 26405 | - | Condominium | 1 | 99 yrs from 12/09/2022 | Uncompleted | Private | 598444 | 21 | 59 | Central Region | Bukit Timah |

| THE RESERVE RESIDENCES | 3412201 | 1323.97 | 2577 | 01 Jan 2024 | 13 JALAN ANAK BUKIT #28-106 | New Sale | Strata | 123 | 27741 | - | Apartment | 1 | 99 yrs from 29/11/2021 | Uncompleted | Private | 589605 | 21 | 58 | Central Region | Bukit Timah |

| SUMMER VILLAS | 2960000 | 3530.59 | 838 | 02 Jan 2024 | 73 GERALD DRIVE #01-06 | Resale | Strata | 328 | 9024 | - | Terrace House | 1 | Freehold | 2004 | Private | 797703 | 28 | 79 | North East Region | Hougang |

There are 4,902 private residential property sales for 2024 Q1.

glimpse(realis_2023q1)Rows: 4,722

Columns: 21

$ PROJECT_NAME <chr> "THE REEF AT KING'S DOCK", "URBAN TREASURE…

$ TRANSACTED_PRICE <dbl> 2317000, 1823500, 1421112, 1258112, 128000…

$ AREA_SQFT <dbl> 882.65, 882.65, 1076.40, 1033.34, 871.88, …

$ UNIT_PRICE_PSF <dbl> 2625, 2066, 1320, 1218, 1468, 1767, 1095, …

$ SALE_DATE <chr> "01 Jan 2023", "02 Jan 2023", "02 Jan 2023…

$ ADDRESS <chr> "12 HARBOURFRONT AVENUE #05-32", "205 JALA…

$ TYPE_OF_SALE <chr> "New Sale", "New Sale", "New Sale", "New S…

$ TYPE_OF_AREA <chr> "Strata", "Strata", "Strata", "Strata", "S…

$ AREA_SQM <dbl> 82.0, 82.0, 100.0, 96.0, 81.0, 308.7, 420.…

$ UNIT_PRICE_PSM <dbl> 28256, 22238, 14211, 13105, 15802, 19015, …

$ NETT_PRICE <chr> "-", "-", "-", "-", "-", "-", "-", "-", "-…

$ PROPERTY_TYPE <chr> "Condominium", "Condominium", "Executive C…

$ NUMBER_OF_UNITS <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, …

$ TENURE <chr> "99 yrs from 12/01/2021", "Freehold", "99 …

$ COMPLETION_DATE <chr> "Uncompleted", "Uncompleted", "Uncompleted…

$ PURCHASER_ADDRESS_INDICATOR <chr> "HDB", "Private", "HDB", "HDB", "HDB", "Pr…

$ POSTAL_CODE <chr> "097996", "419535", "269343", "269294", "7…

$ POSTAL_DISTRICT <chr> "04", "14", "27", "27", "28", "19", "10", …

$ POSTAL_SECTOR <chr> "09", "41", "26", "26", "79", "54", "27", …

$ PLANNING_REGION <chr> "Central Region", "East Region", "North Re…

$ PLANNING_AREA <chr> "Bukit Merah", "Bedok", "Yishun", "Yishun"…The imported dataset has 21 variables.

3.2 Combining the dataframes

Next, we will combine all 5 realis_202*q* dataframes into a single one to simplify aggregation and partitioning of data for analysis.

This will also simplify cleanup and transformation as they will be done on a single dataframe instead of 5.

To do this, we need to add QUARTER values to each dataframe before merging them to a single one. We will use the format <YEAR>Q<QUARTER>, i.e 2024Q1 for 2024 Q1. This is so we can identify which quarter the sale was made, which we will use for aggregation.

mutate()for adding new columnrbind()for combining all dataframesseq_len()andnrow()for generating a sequence of IDssprintf()for formatting a string.

realis_2023q1 <- mutate(realis_2023q1, QUARTER="2023Q1")

realis_2023q2 <- mutate(realis_2023q2, QUARTER="2023Q2")

realis_2023q3 <- mutate(realis_2023q3, QUARTER="2023Q3")

realis_2023q4 <- mutate(realis_2023q4, QUARTER="2023Q4")

realis_2024q1 <- mutate(realis_2024q1, QUARTER="2024Q1")realis <- realis_2023q1 %>%

rbind(realis_2023q2) %>%

rbind(realis_2023q3) %>%

rbind(realis_2023q4) %>%

rbind(realis_2024q1)

kable(head(realis, n=10))| PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | SALE_DATE | ADDRESS | TYPE_OF_SALE | TYPE_OF_AREA | AREA_SQM | UNIT_PRICE_PSM | NETT_PRICE | PROPERTY_TYPE | NUMBER_OF_UNITS | TENURE | COMPLETION_DATE | PURCHASER_ADDRESS_INDICATOR | POSTAL_CODE | POSTAL_DISTRICT | POSTAL_SECTOR | PLANNING_REGION | PLANNING_AREA | QUARTER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| THE REEF AT KING’S DOCK | 2317000 | 882.65 | 2625 | 01 Jan 2023 | 12 HARBOURFRONT AVENUE #05-32 | New Sale | Strata | 82.0 | 28256 | - | Condominium | 1 | 99 yrs from 12/01/2021 | Uncompleted | HDB | 097996 | 04 | 09 | Central Region | Bukit Merah | 2023Q1 |

| URBAN TREASURES | 1823500 | 882.65 | 2066 | 02 Jan 2023 | 205 JALAN EUNOS #08-02 | New Sale | Strata | 82.0 | 22238 | - | Condominium | 1 | Freehold | Uncompleted | Private | 419535 | 14 | 41 | East Region | Bedok | 2023Q1 |

| NORTH GAIA | 1421112 | 1076.40 | 1320 | 02 Jan 2023 | 29 YISHUN CLOSE #08-10 | New Sale | Strata | 100.0 | 14211 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 269343 | 27 | 26 | North Region | Yishun | 2023Q1 |

| NORTH GAIA | 1258112 | 1033.34 | 1218 | 02 Jan 2023 | 45 YISHUN CLOSE #07-42 | New Sale | Strata | 96.0 | 13105 | - | Executive Condominium | 1 | 99 yrs from 15/02/2021 | Uncompleted | HDB | 269294 | 27 | 26 | North Region | Yishun | 2023Q1 |

| PARC BOTANNIA | 1280000 | 871.88 | 1468 | 03 Jan 2023 | 12 FERNVALE STREET #06-16 | Resale | Strata | 81.0 | 15802 | - | Condominium | 1 | 99 yrs from 28/12/2016 | 2022 | HDB | 797391 | 28 | 79 | North East Region | Sengkang | 2023Q1 |

| NANYANG PARK | 5870000 | 3322.85 | 1767 | 03 Jan 2023 | 72 JALAN LIMBOK | Resale | Land | 308.7 | 19015 | - | Terrace House | 1 | 999 yrs from 14/02/1881 | - | Private | 548742 | 19 | 54 | North East Region | Hougang | 2023Q1 |

| PALMS @ SIXTH AVENUE | 4950000 | 4520.88 | 1095 | 03 Jan 2023 | 231 SIXTH AVENUE | Resale | Strata | 420.0 | 11786 | - | Semi-Detached House | 1 | Freehold | 2015 | Private | 275780 | 10 | 27 | Central Region | Bukit Timah | 2023Q1 |

| N.A. | 3260000 | 1555.40 | 2096 | 03 Jan 2023 | 19 TENG TONG ROAD | Resale | Land | 144.5 | 22561 | - | Terrace House | 1 | Freehold | 1941 | Private | 423510 | 15 | 42 | Central Region | Marine Parade | 2023Q1 |

| WHISTLER GRAND | 850000 | 441.32 | 1926 | 03 Jan 2023 | 107 WEST COAST VALE #30-04 | Sub Sale | Strata | 41.0 | 20732 | - | Apartment | 1 | 99 yrs from 07/05/2018 | 2022 | HDB | 126751 | 05 | 12 | West Region | Clementi | 2023Q1 |

| NORTHOAKS | 1268000 | 1603.84 | 791 | 03 Jan 2023 | 30 WOODLANDS CRESCENT #01-11 | Resale | Strata | 149.0 | 8510 | - | Executive Condominium | 1 | 99 yrs from 16/12/1997 | 2000 | HDB | 738086 | 25 | 73 | North Region | Woodlands | 2023Q1 |

We will also add TXN_ID so we can more easily refer to the observations later on. The format is TXN00000.

realis$TXN_ID <- sprintf("TXN%05d", seq_len(nrow(realis)))Let us check if all rows are accounted for by checking if the number of rows in realis is the total number of rows from all dataframes.

nrow(realis) == nrow(realis_2023q1) +

nrow(realis_2023q2) +

nrow(realis_2023q3) +

nrow(realis_2023q4) +

nrow(realis_2024q1)[1] TRUE3.3 Filtering relevant columns

After adding the QUARTER and TXN_ID columns, there are now 23 variables in the dataframe. However, not all of them are relevant to answer the questions we are asking. The table below summarizes the columns and whether we will keep them or not.

| Column Name | Description | Reason |

|---|---|---|

| TXN_ID | Identifier for the transaction | It is an identifier |

| QUARTER | Quarter when the property was sold | Core data for aggregation |

| PROJECT_NAME | Name of the project | Can be used to pinpoint popular projects |

| TRANSACTED_PRICE | Transaction price (SGD) | Useful for deriving insights |

| AREA_SQFT | Area of the property in sqft | Useful for deriving insights |

| UNIT_PRICE_PSF | Price per sqft | Useful for price analysis |

| TYPE_OF_SALE | One of New Sale, Resale, Subsale | Important submarket information |

| TYPE_OF_AREA | One of Landed, Strata | Can be used to partition data |

| PROPERTY_TYPE | Type of Property, e.g. Apartment, Condominium, Executive Condominium, Terrace House, Semi-Detached House, Detached House | Can be used to partition data |

| NUMBER_OF_UNITS | Number of units involved in the transaction | Core data for analysis |

| POSTAL_DISTRICT | District where the property is located | Can be used to partition data |

| TENURE | Can be Freehold or Leasehold | Can be used to partition data |

| Column Name | Description | Reason |

|---|---|---|

| SALE_DATE | Date when the sale was made | We will aggregate by quarter, no need to know the specific dates. |

| ADDRESS | Property Address | Will use PROJECT_NAME if needed to pinpoint projects |

| AREA_SQM | Price per sqm | AREA_SFT is adequate |

| UNIT_PRICE_PSM | Price per sqm | UNIT_PRICE_PSF is adequate |

| NETT_PRICE | Column is blank | |

| COMPLETION_DATE | When the property was completed. Some properties are Uncompleted as they will be turned over for the future | Other attributes (e.g. TYPE_OF_SALE, PROPERTY_TYPE) are more important for checking submarket trends |

| PURCHASER_ADDRESS_INDICATOR | Type of residence of the purchaser | No interest in buyer’s current address |

| POSTAL_CODE | Postal code of the property | Will use POSTAL_DISTRICT for location |

| POSTAL_SECTOR | Sector where the property is located | Will use POSTAL_DISTRICT for location |

| PLANNING_REGION | Region where the property is located | Will use POSTAL_DISTRICT for location |

| PLANNING_AREA | Area where the property is located | Will use POSTAL_DISTRICT for location |

We will now use select() to keep only the relevant columns. We will define the function below for filtering the relevant columns. This will also rearrange the columns based on the order in the function call.

realis <-

realis %>% select(

c(

TXN_ID,

QUARTER,

PROJECT_NAME,

TRANSACTED_PRICE,

AREA_SQFT,

UNIT_PRICE_PSF,

TYPE_OF_SALE,

TYPE_OF_AREA,

PROPERTY_TYPE,

NUMBER_OF_UNITS,

POSTAL_DISTRICT,

TENURE

)

)

glimpse(realis)Rows: 26,806

Columns: 12

$ TXN_ID <chr> "TXN00001", "TXN00002", "TXN00003", "TXN00004", "TXN0…

$ QUARTER <chr> "2023Q1", "2023Q1", "2023Q1", "2023Q1", "2023Q1", "20…

$ PROJECT_NAME <chr> "THE REEF AT KING'S DOCK", "URBAN TREASURES", "NORTH …

$ TRANSACTED_PRICE <dbl> 2317000, 1823500, 1421112, 1258112, 1280000, 5870000,…

$ AREA_SQFT <dbl> 882.65, 882.65, 1076.40, 1033.34, 871.88, 3322.85, 45…

$ UNIT_PRICE_PSF <dbl> 2625, 2066, 1320, 1218, 1468, 1767, 1095, 2096, 1926,…

$ TYPE_OF_SALE <chr> "New Sale", "New Sale", "New Sale", "New Sale", "Resa…

$ TYPE_OF_AREA <chr> "Strata", "Strata", "Strata", "Strata", "Strata", "La…

$ PROPERTY_TYPE <chr> "Condominium", "Condominium", "Executive Condominium"…

$ NUMBER_OF_UNITS <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1,…

$ POSTAL_DISTRICT <chr> "04", "14", "27", "27", "28", "19", "10", "15", "05",…

$ TENURE <chr> "99 yrs from 12/01/2021", "Freehold", "99 yrs from 15…After this initial cleanup, we are left with 12 variables relevant to our exploration.

Let us save realis so we do not need to rerun the steps above.

write_rds(realis, "data/rds/realis_cleaned.rds")We do not need the realis_202*q* dataframes anymore so we can remove them from the RStudio environment.

rm(realis_2023q1)

rm(realis_2023q2)

rm(realis_2023q3)

rm(realis_2023q4)

rm(realis_2024q1)3.4 Closer look at NUMBER_OF_UNITS

We can continue running the document from this point by loading the following prepared data.

realis <- read_rds("data/rds/realis_cleaned.rds")Taking a closer look at NUMBER_OF_UNITS columns reveals that 12 out of 26,806 transactions involve multiple units.

realis[order(-realis$NUMBER_OF_UNITS),] %>% filter(NUMBER_OF_UNITS > 1) %>% kable()| TXN_ID | QUARTER | PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | TYPE_OF_SALE | TYPE_OF_AREA | PROPERTY_TYPE | NUMBER_OF_UNITS | POSTAL_DISTRICT | TENURE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN01567 | 2023Q1 | MEYER PARK | 392180000 | 144883.44 | 2707 | Resale | Strata | Condominium | 60 | 15 | Freehold |

| TXN00083 | 2023Q1 | BAGNALL COURT | 115280000 | 68491.33 | 1683 | Resale | Strata | Condominium | 43 | 16 | Freehold |

| TXN08370 | 2023Q2 | KEW LODGE | 66800000 | 25177.00 | 2653 | Resale | Strata | Terrace House | 11 | 11 | Freehold |

| TXN17572 | 2023Q4 | KARTAR APARTMENTS | 18000000 | 6964.31 | 2585 | Resale | Strata | Apartment | 7 | 11 | Freehold |

| TXN00861 | 2023Q1 | MONDO MANSION BUILDING | 6280000 | 5489.64 | 1144 | Resale | Strata | Apartment | 4 | 19 | Freehold |

| TXN10593 | 2023Q2 | N.A. | 10600000 | 6746.88 | 1571 | Resale | Strata | Apartment | 4 | 15 | Freehold |

| TXN04100 | 2023Q1 | N.A. | 61080008 | 32148.84 | 1900 | Resale | Land | Detached House | 3 | 11 | Freehold |

| TXN06865 | 2023Q2 | N.A. | 32200000 | 14123.44 | 2280 | Resale | Land | Detached House | 2 | 11 | Freehold |

| TXN10316 | 2023Q2 | N.A. | 6150000 | 4342.20 | 1416 | Resale | Land | Semi-Detached House | 2 | 19 | Freehold |

| TXN12792 | 2023Q3 | EAST VIEW GARDEN | 6100000 | 8337.79 | 732 | Resale | Land | Semi-Detached House | 2 | 16 | Freehold |

| TXN13376 | 2023Q3 | N.A. | 8000000 | 3658.68 | 2187 | Resale | Land | Semi-Detached House | 2 | 14 | Freehold |

| TXN24770 | 2024Q1 | CLAYMORE PLAZA | 7000000 | 4208.72 | 1663 | Resale | Strata | Apartment | 2 | 09 | Freehold |

Furthermore, the TRANSACTED_PRICE for such transactions are hundred million dollar transactions, which can skew the data if we are looking at TRANSACTED_PRICE with the assumption that it is the price per unit.

For example TXN01567, is worth $392,180,000, which is much higher that the price of individual units

3.5 Handling the bulk transactions

To address the 12 bulk transactions in our dataframe, we have 2 possible options:

Option 1: Remove these transactions as these correspond to 0.045% of transactions (EASY)

Option 2: Create rows for each unit in the transaction (HARD)

Although Option 2 is more difficult, it is the better approach as all the transactions are Resale transactions. Simply removing them may remove very important data for the resale submarket.

For this solution, we need to do the following:

- Repeat all rows by

NUMBER_OF_UNITStimes. - Set transacted price to the average price:

- Set the area (sqft) to the average area:

- Set

NUMBER_OF_UNITSto 1.

Reference: Stackoverflow

rep() - to repeat a dataframe

seq_len(nrow()) - to iterate to each row of the dataframe

sales_txns <- realis[rep(seq_len(nrow(realis)), realis$NUMBER_OF_UNITS),]Lets’ check if the number of rows correspond to the total number of units sold.

nrow(sales_txns) == sum(realis$NUMBER_OF_UNITS)[1] TRUEWe will perform the changes to NUMBER_OF_UNITS, TRANSACTED_PRICE, AREA_SQFT in 1 code chunk so that rerunning the code chunk is idempotent and won’t mutate the variable further

sales_txns <- sales_txns %>%

filter(NUMBER_OF_UNITS > 1) %>%

mutate(TRANSACTED_PRICE = round(TRANSACTED_PRICE / NUMBER_OF_UNITS, 0)) %>%

mutate(AREA_SQFT = round(AREA_SQFT / NUMBER_OF_UNITS, 0)) %>%

mutate(NUMBER_OF_UNITS = 1) %>%

rbind(sales_txns %>% # Reconnect to the rest of the dataframe

filter(NUMBER_OF_UNITS == 1))Let us verify the result of the transformation.

realis %>%

filter(TXN_ID %in% c(

"TXN00001", "TXN00002", # Single-unit transactions

"TXN10593", "TXN13376" # Bulk transactions

)) %>% kable()| TXN_ID | QUARTER | PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | TYPE_OF_SALE | TYPE_OF_AREA | PROPERTY_TYPE | NUMBER_OF_UNITS | POSTAL_DISTRICT | TENURE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN00001 | 2023Q1 | THE REEF AT KING’S DOCK | 2317000 | 882.65 | 2625 | New Sale | Strata | Condominium | 1 | 04 | 99 yrs from 12/01/2021 |

| TXN00002 | 2023Q1 | URBAN TREASURES | 1823500 | 882.65 | 2066 | New Sale | Strata | Condominium | 1 | 14 | Freehold |

| TXN10593 | 2023Q2 | N.A. | 10600000 | 6746.88 | 1571 | Resale | Strata | Apartment | 4 | 15 | Freehold |

| TXN13376 | 2023Q3 | N.A. | 8000000 | 3658.68 | 2187 | Resale | Land | Semi-Detached House | 2 | 14 | Freehold |

sales_txns %>%

filter(TXN_ID %in% c(

"TXN00001", "TXN00002", # Single-unit transactions

"TXN10593", "TXN13376" # Bulk transactions

)) %>% kable()| TXN_ID | QUARTER | PROJECT_NAME | TRANSACTED_PRICE | AREA_SQFT | UNIT_PRICE_PSF | TYPE_OF_SALE | TYPE_OF_AREA | PROPERTY_TYPE | NUMBER_OF_UNITS | POSTAL_DISTRICT | TENURE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN10593 | 2023Q2 | N.A. | 2650000 | 1687.00 | 1571 | Resale | Strata | Apartment | 1 | 15 | Freehold |

| TXN10593 | 2023Q2 | N.A. | 2650000 | 1687.00 | 1571 | Resale | Strata | Apartment | 1 | 15 | Freehold |

| TXN10593 | 2023Q2 | N.A. | 2650000 | 1687.00 | 1571 | Resale | Strata | Apartment | 1 | 15 | Freehold |

| TXN10593 | 2023Q2 | N.A. | 2650000 | 1687.00 | 1571 | Resale | Strata | Apartment | 1 | 15 | Freehold |

| TXN13376 | 2023Q3 | N.A. | 4000000 | 1829.00 | 2187 | Resale | Land | Semi-Detached House | 1 | 14 | Freehold |

| TXN13376 | 2023Q3 | N.A. | 4000000 | 1829.00 | 2187 | Resale | Land | Semi-Detached House | 1 | 14 | Freehold |

| TXN00001 | 2023Q1 | THE REEF AT KING’S DOCK | 2317000 | 882.65 | 2625 | New Sale | Strata | Condominium | 1 | 04 | 99 yrs from 12/01/2021 |

| TXN00002 | 2023Q1 | URBAN TREASURES | 1823500 | 882.65 | 2066 | New Sale | Strata | Condominium | 1 | 14 | Freehold |

Let us save sales_txns so we do not need to rerun the steps above.

write_rds(sales_txns, "data/rds/sales_txns.rds")We will use sales_txns from now on so we can remove realis from the environment.

rm(realis)4 Data Exploration

We can continue running the document from this point by loading the following prepared data.

sales_txns <- read_rds("data/rds/sales_txns.rds")4.1 Defining the audience and purpose of the visualizations

4.1.1 Considerations

It is important to note that it is quite challenging to present all data available with just 3 visualizations. We cannot cover all ground and visualize the data from all perspectives, and some blind spots and biases are bound occur in the process.

With this in mind, it is important that we define the audience and purpose of the visualizations.

The audience is a prospective private property buyer that needs help answering these questions in making decisions on buying property:

- Should I buy a new property or a resale property?

- Should I buy a condo, apartment, or is it worth it to save more for a landed property?

- Which districts should I consider when buying a property?

- Do I get a bargain compared to buying a property last year?

To answer the questions above, we will focus on exploring and visualizing the distribution among the different markets (New Sale, Resale, Sub Sale).

The points of interest are:

Prices (unit and total)

Distribution across different markets

Distribution by property type

As we have limited space to present data (within 2-3 visualizations), we cannot include all the data available to us.

With this, some perspectives may be missed and we will not be able to dive deep enough all aspects of the data.

4.1.2 Unit Price vs Transacted Price

Given AREA_SQFT and UNIT_PRICE_PSF, it is intuitive to expect that:

However, there are only 7 out of 26,936 transactions for which this is true.

sales_txns %>% filter(TRANSACTED_PRICE == AREA_SQFT * UNIT_PRICE_PSF) %>% nrow()[1] 7This is because the final transacted price depends on other factors like size of property, floor height, where the property is facing, etc. Most of these factors are not reflected in the dataset we have.

Hence, to have a fairer comparison with what we have, we will use UNIT_PRICE_PSF for price comparisons.

4.1.3 Compare all quarters or two quarters

In answering the questions we define (and based on the specifications of the exercise), the data partition for the visualization is by TYPE_OF_SALE as we want to look for trends from the different submarkets.

We current have 5 quarters in our dataset, 3 submarkets. This means 15 facets, which may be too much for division for visualization. It is also difficult to see at a glance when information we are trying to communicate if there are many very small graphs.

In addition, if we want to dive even deeper by PROPERTY_TYPE, which has 6 possible values, that is 90 data subsets we need to present.

Hence to simplify the visualization, we will choose only the 2023Q1 and 2024Q1, which should suffice for our purpose of comparing the state of the market to last year’s as we are comparing the same time of the year.

Hence, we will produce the data frames to contain these data.

sales_txns_q1_2324 <- sales_txns %>% filter(QUARTER %in% c("2023Q1", "2024Q1"))

sales_txns_q1_23 <- sales_txns_q1_2324 %>% filter(QUARTER == "2023Q1")

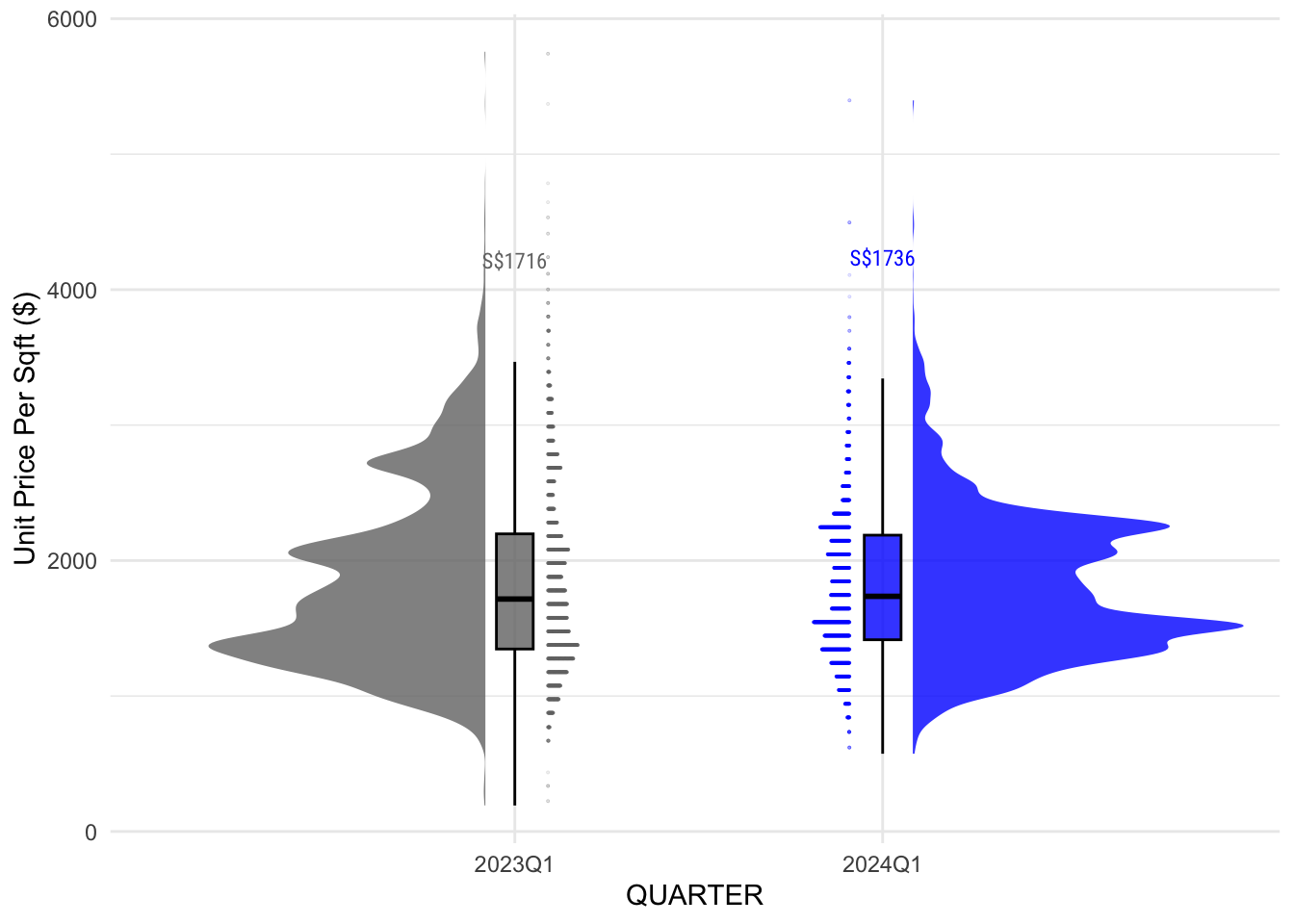

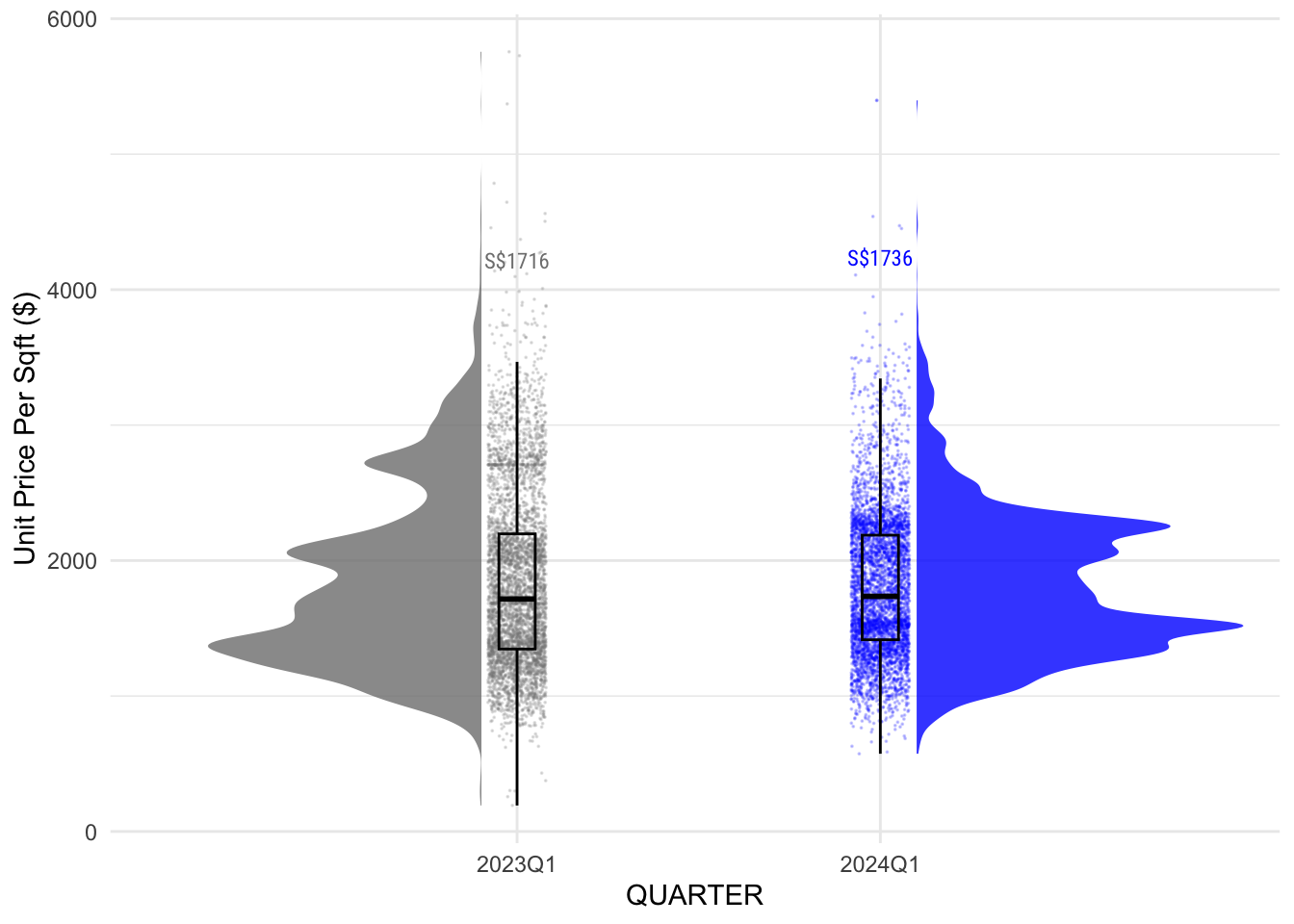

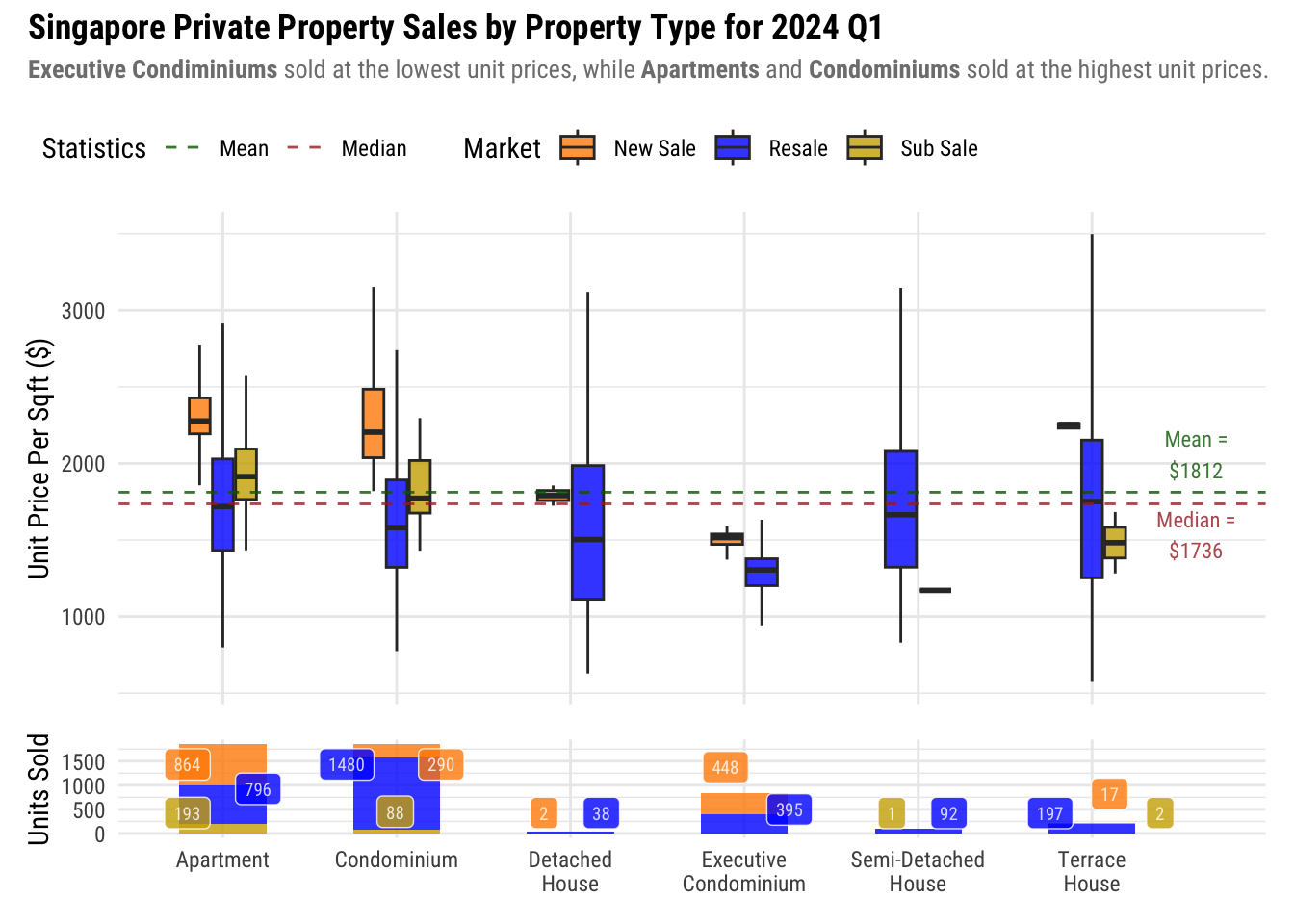

sales_txns_q1_24 <- sales_txns_q1_2324 %>% filter(QUARTER == "2024Q1")4.2 Visualization 1: 2023Q1 and 2024Q1 prices

First we will compare the prices between the First Quarter of 2023 and 2024. This is to compare the prices at the same time of the year.

For this visualization, we will use the Unit Price per Sqft (UNIT_PRICE_PSF) instead of the Transaction Price (TRANSACTED_PRICE). This is so we can more fairly compare prices with less variables involved. With Transaction Price, the size of the property needs to be considered.

We will use the TYPE_OF_SALE column to partition the data so we can compare the trends across the Resale, New Sale and Sub Sale markets.

4.2.1 Creating the base Visualization

For the visualization, we will use a Raincloud Plot so that we can see the patterns in the price trends, and whether there are clusters of interest within the data set.

We will also add a boxplot to accompany the half-density plot so that we can see the quantiles more clearly.

To compare the different quarters, we will use both left side and right side visualization to compare the quarters side by side. This is inspired by a senior’s work.

To visualize the volumes, the 2 options are using stat_dots() or geom_jitter().

Show ggplot2 code

plot_q1_yoy_psf_price <- function() {

ggplot(

sales_txns_q1_2324,

aes(

x = QUARTER,

y = UNIT_PRICE_PSF,

fill = QUARTER,

color = QUARTER

)

) +

# Generate half-density plot

stat_halfeye(

aes(

justification = ifelse(QUARTER == "2023Q1", 1.20, 0.02),

side = ifelse(QUARTER == "2023Q1", "left", "right")

),

position = position_nudge(x = 0.1, y = 0),

.width = 0,

alpha = 0.8,

point_color = NA,

show.legend = FALSE

) +

# Generate boxplot along edge of half-density plot

geom_boxplot(

outlier.shape = NA,

alpha = 0.8,

width = .1,

color = "black",

show.legend = FALSE

) +

# Generate volume plots, adjusting sizing so as to not overflow into the other half

stat_dots(

aes(

side = ifelse(QUARTER == "2024Q1", "left", "right"),

justification = ifelse(QUARTER == "2024Q1", 1.10,-0.1)

),

binwidth = 100,

dotsize = 0.005,

alpha = 0.2,

show.legend = FALSE

) +

# Add text about the median price

stat_summary(

aes(label = paste0("S$", after_stat(y))),

geom = "text",

fun = "median",

position = position_nudge(y = 2500),

family = "Roboto Condensed",

size = 3,

show.legend = FALSE

) +

# Set colors and fill

# Keep it simple, and use bright color for 20424Q1 it is the focus of visualization

scale_color_manual(values = c("grey45", "blue")) +

scale_fill_manual(values = c("grey45", "blue")) +

labs(y = "Unit Price Per Sqft ($)") +

# Next steps will take care of theme enhancements

theme_minimal()

}

plot_q1_yoy_psf_price()

Show ggplot2 code

plot_q1_yoy_psf_price_alt <- function() {

ggplot(

sales_txns_q1_2324,

aes(

x = QUARTER,

y = UNIT_PRICE_PSF,

fill = QUARTER,

color = QUARTER

)

) +

# Generate half-density plot

stat_halfeye(

aes(

fill = QUARTER,

justification = ifelse(QUARTER == "2023Q1", 1.22, 0),

side = ifelse(QUARTER == "2023Q1", "left", "right")

),

position = position_nudge(x = 0.1, y = 0),

.width = 0,

alpha = 0.8,

point_color = NA,

show.legend = FALSE

) +

# Generate jitter plot under the geom plot so the dots don't overpower the boxplot

geom_jitter(

width = 0.08,

size = 0.01,

alpha = 0.2,

show.legend = FALSE

) +

# Generate boxplot along edge of half-density plot

geom_boxplot(

outlier.shape = NA,

alpha = 0,

width = 0.1,

color = "black",

show.legend = FALSE

) +

# Add text about the median price

stat_summary(

aes(label = paste0("S$", after_stat(y))),

geom = "text",

fun = "median",

position = position_nudge(y = 2500),

family = "Roboto Condensed",

size = 3,

show.legend = FALSE

)+

# Set colors and fill

# Keep it simple, and use bright color for 20424Q1 it is the focus of visualization

scale_fill_manual(values = c("grey50", "blue")) +

scale_color_manual(values = c("grey50", "blue")) +

labs(y = "Unit Price Per Sqft ($)") +

# Next steps will take care of theme enhancements

theme_minimal()

}

plot_q1_yoy_psf_price_alt()

Using stat_dots() is better than geom_jitter() as the purpose of providing volume information here is to accompany the half-density plot and provide a tool to compare the volume of each submarket.

Comparing the length of each horizontal line is much easier to do than comparing how dark each area is in a jitter plot.

Now that we have the base visualization, we will generate the final visualization.

4.2.2 Adding the % change

When generating the facet name, we also can add the % change so that it is clear for the audience how much the prices change.

We will use the following function to render the % change, which will show as +x.x% when there is an increase, and -x.x% when there is a decrease.

show_price_pc_change <- function(market = "1") {

data2023 = sales_txns_q1_23

data2024 = sales_txns_q1_24

# 1 is the facet name for All markets

if (market != "1") {

data2023 = data2023 %>% filter(TYPE_OF_SALE == market)

data2024 = data2024 %>% filter(TYPE_OF_SALE == market)

} else {

market = "All Markets"

}

median2023 = data2023$UNIT_PRICE_PSF %>% median()

median2024 = data2024$UNIT_PRICE_PSF %>% median()

sprintf(

"%s (<span style='color:%s;'>**%s%0.1f%%**</span>)",

market,

ifelse(median2024 < median2023, "brown", "darkgreen"),

ifelse(median2024 < median2023, "-", "+"),

(median2024 - median2023) * 100 / median2023

)

}4.2.3 Generating the visualization

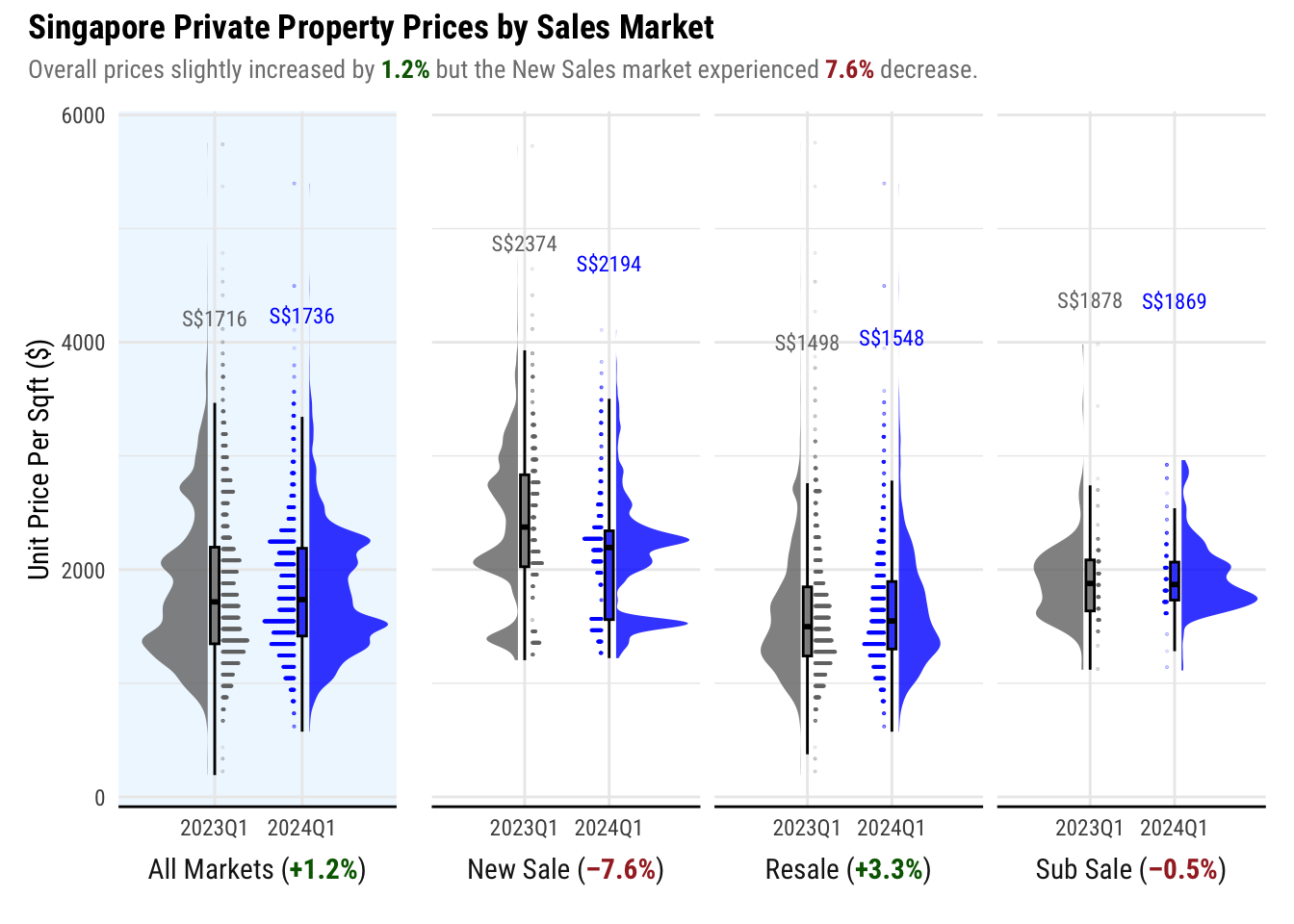

We want to compare the 2023 and 2024 Q1 sales for different submarkets. To do this, we will use facet_wrap() on TYPE_OF_SALE.

In addition, we will add another facet for All Markets for the overall comparison.

These 2 plots will be shown side by side using patchwork.

We can also use facet_grid(margin = TRUE) to generate a facet with all the data, instead of generating 2 separate plots.

However, I would like to change the panel color for the overall plot to highlight it but I couldn’t find a way to do it within facet_grid().

Show ggplot2 code

q1_yoy_psf_price_submarkets_graph <- plot_q1_yoy_psf_price() +

facet_wrap( ~ TYPE_OF_SALE,

strip.position = "bottom",

labeller = labeller(

TYPE_OF_SALE = c(

"New Sale" = show_price_pc_change("New Sale"),

"Sub Sale" = show_price_pc_change("Sub Sale"),

"Resale" = show_price_pc_change("Resale")

)

)) +

theme_minimal() +

theme(axis.title.y = element_blank(),

axis.text.y = element_blank())

q1_yoy_psf_price_all_markets_graph <- plot_q1_yoy_psf_price() +

facet_wrap(

~ NUMBER_OF_UNITS,

strip.position = "bottom",

labeller = as_labeller(show_price_pc_change)

) +

labs(x = "Transaction Price (,000 SGD)") +

theme(panel.background = element_rect(fill = "aliceblue", linewidth =

0))

# As much as we want the plot annotations to be dynamic, the subtitle is depending on the actual data

# Only this part is hardcoded

viz1 <- (q1_yoy_psf_price_all_markets_graph |

q1_yoy_psf_price_submarkets_graph) +

plot_layout(widths = c(1, 3)) +

plot_annotation(title = "Singapore Private Property Prices by Sales Market",

subtitle = "Overall prices slightly increased by <span style='color:darkgreen;'>**1.2%**</span> but the New Sales market experienced <span style='color:brown;'>**7.6%**</span> decrease.") &

theme(

text = element_text(family = "Roboto Condensed"),

axis.line.x = element_line(),

axis.title.x = element_blank(),

axis.ticks.y = element_blank(),

plot.title = element_text(face = "bold"),

plot.subtitle = element_markdown(color = "grey50", size = rel(0.9)),

strip.placement = "outside",

strip.text = element_markdown(size = rel(1))

)

viz1

While the market generally saw a slight increase in unit prices from Q1 2023, the New Sale market experienced a decline. Notable clusters in the graph suggest concentrated sales around specific price points, likely influenced by factors such as developer pricing and the location of New Launches. According to data from 99.co, there are fewer than 10 New Launches in 2024.

New Launched projects, particularly big ones, resulted in clusters on certain price points as they introduce fresh supply in the districts they are located in. The demand for these properties also contributed to the trend as transactions are completed by buyers.

In contrast, the Resale Market, which is comprised of properties already turned over by developers, shows a smoother distribution of prices. This is attributed to the wider variation in prices negotiated between buyers and sellers on available properties all over Singapore, which is not constrained by the parameters of specific projects.

However, it is important to note that visualization can be very misleading especially on the New Sale Market. Generalizing that the trends when there are notable cluster may not be representative of the real state of the market.

Hence, we need to look more deeply into these groups and present it as a visualizations so it can be better understood why there are groups that formed.

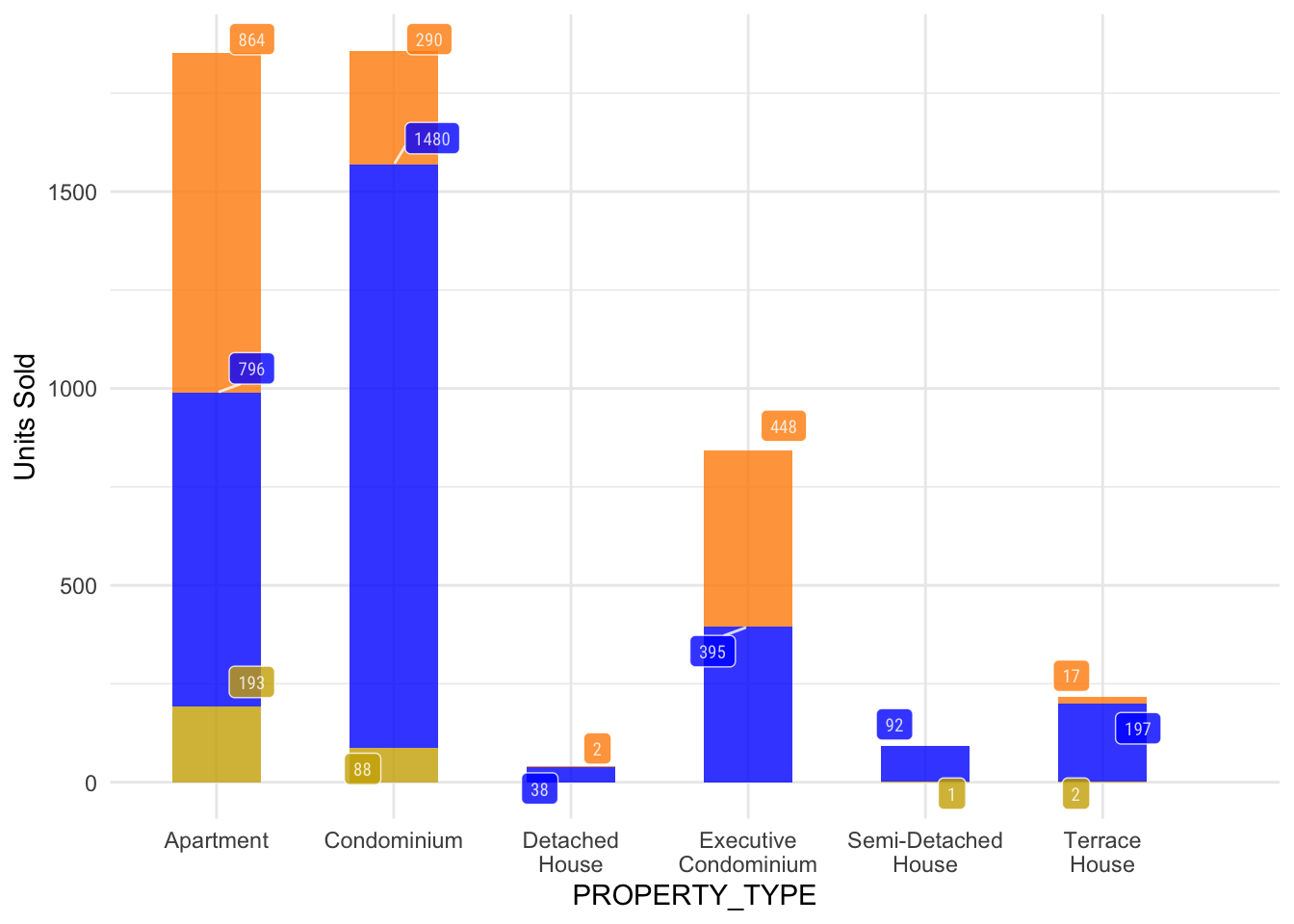

4.3 Visualization 2: 2023Q1 and 2024Q1 Sales Volume

4.3.1 Understanding the groups in New Sales Market

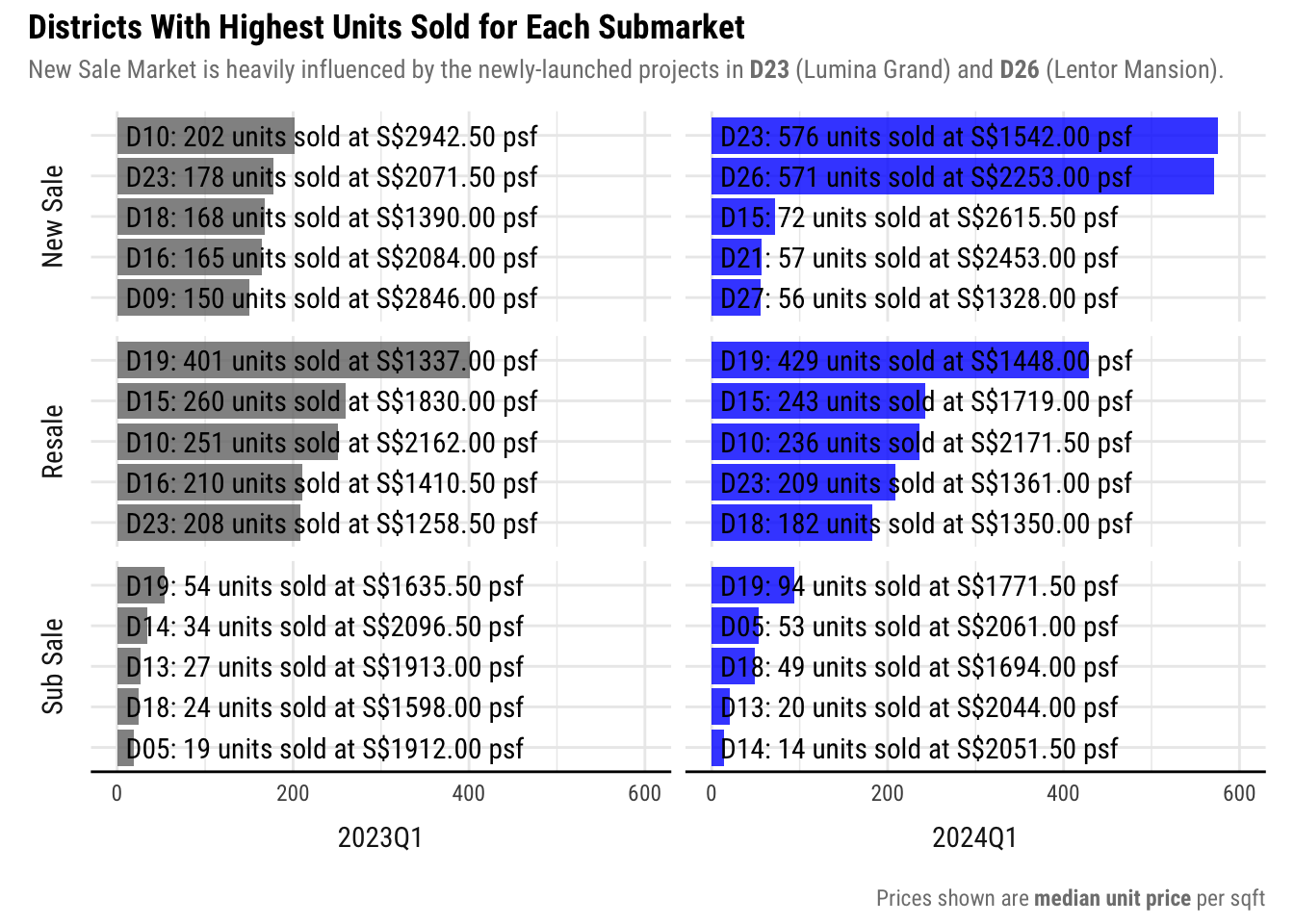

We hypothesized that the groups that are present in the New Sales plot is due to the sales of newly-launched projects.

We will check the aggregated data by PROJECT_NAME and POSTAL_DISTRICT to verify our hypothesis that the sales are clustered by newly launched projects and their respective districts

We will aggregate the number of sales and median unit price by projects. We will also add POSTAL_DISTRICT to the aggregation group as property prices depend on which district a property is in.

sales_txns_q1_24 %>% filter(TYPE_OF_SALE == "New Sale") %>%

group_by(POSTAL_DISTRICT, PROJECT_NAME) %>%

summarize(

MEDIAN_PRICE_PSF = median(UNIT_PRICE_PSF),

NUMBER_OF_SALES = n()

) %>%

arrange(desc(NUMBER_OF_SALES)) %>%

head(10) %>% kable(row.name = TRUE)| POSTAL_DISTRICT | PROJECT_NAME | MEDIAN_PRICE_PSF | NUMBER_OF_SALES | |

|---|---|---|---|---|

| 1 | 26 | LENTOR MANSION | 2269.0 | 409 |

| 2 | 23 | LUMINA GRAND | 1525.0 | 370 |

| 3 | 23 | HILLHAVEN | 2067.0 | 79 |

| 4 | 26 | LENTORIA | 2129.0 | 60 |

| 5 | 23 | THE BOTANY AT DAIRY FARM | 2019.0 | 59 |

| 6 | 27 | NORTH GAIA | 1326.5 | 54 |

| 7 | 12 | THE ARCADY AT BOON KENG | 2573.5 | 50 |

| 8 | 26 | LENTOR HILLS RESIDENCES | 2109.0 | 49 |

| 9 | 26 | HILLOCK GREEN | 2169.0 | 43 |

| 10 | 23 | THE MYST | 2160.5 | 42 |

We can see that 8 out of 10 projects with highest number of sales are in Districts 23 and 26. This is consistent with our previous observation that there are 2 groups in the New Sales density graph.

Furthermore, in 99.co’s New Launches page, Lentor Mansion (D26) and Lumina Grand (D23) are the biggest projects with the highest number of units sold.

Hence, the density graph could reflected the groups that formed from the sales of properties within these 2 projects.

sales_txns_q1_24 %>% filter(TYPE_OF_SALE == "New Sale") %>%

group_by(POSTAL_DISTRICT) %>%

summarize(

MEDIAN_PRICE_PSF = median(UNIT_PRICE_PSF),

NUMBER_OF_SALES = n()

) %>%

arrange(desc(NUMBER_OF_SALES)) %>%

kable(row.names = TRUE)| POSTAL_DISTRICT | MEDIAN_PRICE_PSF | NUMBER_OF_SALES | |

|---|---|---|---|

| 1 | 23 | 1542.0 | 576 |

| 2 | 26 | 2253.0 | 571 |

| 3 | 15 | 2615.5 | 72 |

| 4 | 21 | 2453.0 | 57 |

| 5 | 27 | 1328.0 | 56 |

| 6 | 12 | 2573.0 | 51 |

| 7 | 11 | 3189.0 | 40 |

| 8 | 10 | 3307.0 | 37 |

| 9 | 03 | 2807.0 | 31 |

| 10 | 05 | 2607.5 | 20 |

| 11 | 28 | 2254.0 | 20 |

| 12 | 16 | 2091.0 | 19 |

| 13 | 22 | 2215.0 | 17 |

| 14 | 09 | 3437.5 | 14 |

| 15 | 02 | 2567.0 | 13 |

| 16 | 07 | 3234.0 | 8 |

| 17 | 19 | 1966.0 | 7 |

| 18 | 14 | 2168.0 | 5 |

| 19 | 18 | 1754.0 | 3 |

| 20 | 04 | 2548.5 | 2 |

| 21 | 17 | 1895.0 | 2 |

Although there are new units across all districts, the big, newly launched projects contributed the most to the New Sales Market.

This is hinted by the fact that after aggregating all property sales by district, D23 and D26 where Lumina Grand and Lentor Mansion stand out. More than 60% of sales from each of these district also come from these 2 projects.

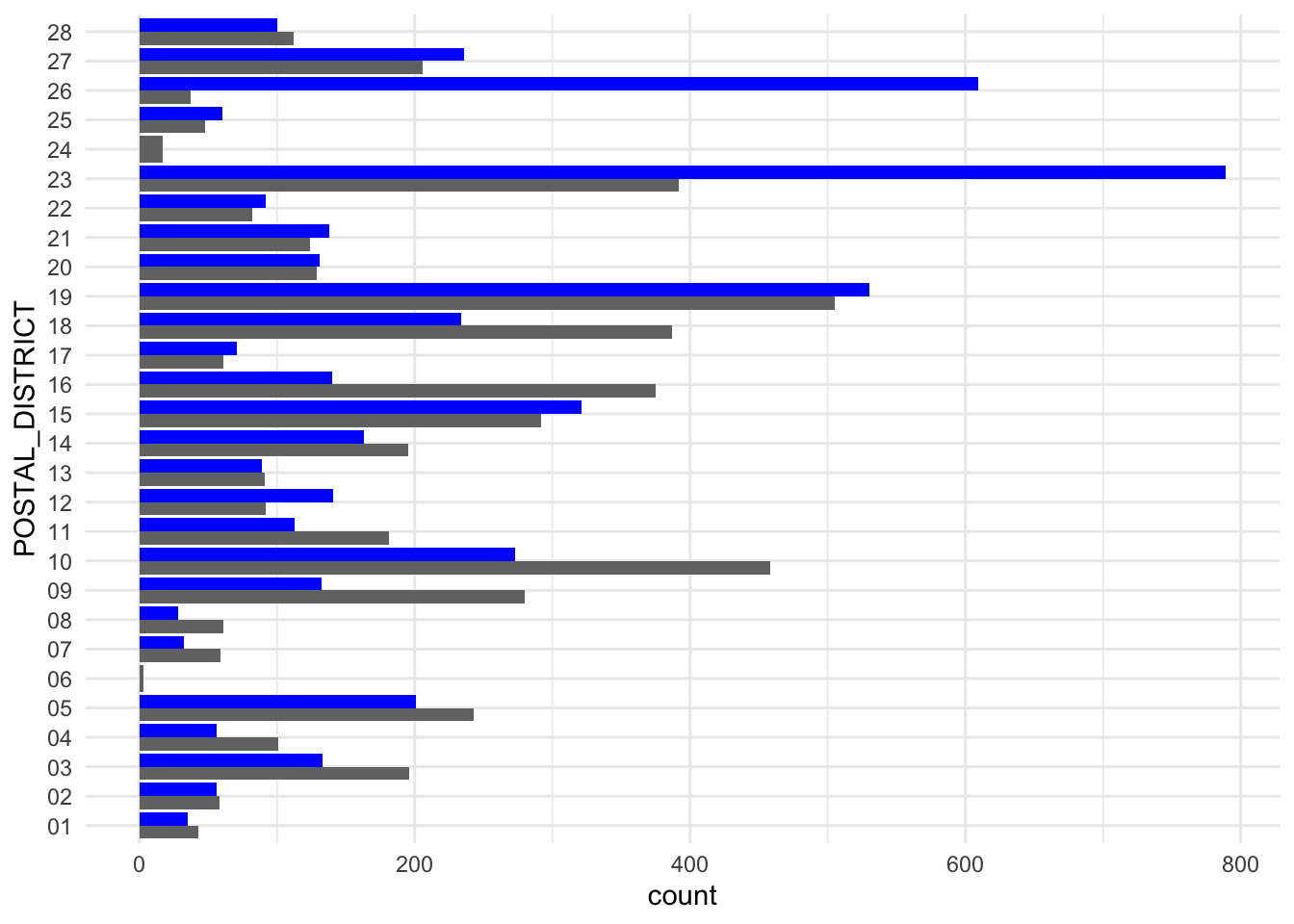

Based on the findings from this deep dive, we will visualize the sales volume by district.

4.3.2. Creating the base visualization

Some of the options we have to visualize the sales by district are:

Bar graph of number of sales for all districts, or

Bar graph of number of sales for most popular districts

plot_q1_yoy_sale_vol <- function() {

ggplot(

sales_txns_q1_2324,

aes(x = POSTAL_DISTRICT, fill = QUARTER)

) +

geom_bar(position="dodge", show.legend = FALSE) +

coord_flip() +

scale_fill_manual(values = c("grey45", "blue")) +

theme_minimal()

}

plot_q1_yoy_sale_vol()

This visualization needs some pre-processing so we can determine the Top 5 most popular districts in each submarket.

popular_districts <- sales_txns_q1_2324 %>%

group_by(QUARTER, POSTAL_DISTRICT, TYPE_OF_SALE) %>%

summarize(

MEDIAN_PRICE_PSF = median(UNIT_PRICE_PSF),

NUMBER_OF_SALES = n()

) %>%

group_by(QUARTER, TYPE_OF_SALE) %>%

arrange(desc(NUMBER_OF_SALES)) %>%

mutate(RANK = order(NUMBER_OF_SALES, decreasing=TRUE)) %>%

filter(RANK <= 5) %>%

select(c(QUARTER, TYPE_OF_SALE, RANK, POSTAL_DISTRICT, NUMBER_OF_SALES, MEDIAN_PRICE_PSF)) %>%

arrange(QUARTER)

kable(popular_districts, row.names = TRUE)| QUARTER | TYPE_OF_SALE | RANK | POSTAL_DISTRICT | NUMBER_OF_SALES | MEDIAN_PRICE_PSF | |

|---|---|---|---|---|---|---|

| 1 | 2023Q1 | Resale | 1 | 19 | 401 | 1337.0 |

| 2 | 2023Q1 | Resale | 2 | 15 | 260 | 1830.0 |

| 3 | 2023Q1 | Resale | 3 | 10 | 251 | 2162.0 |

| 4 | 2023Q1 | Resale | 4 | 16 | 210 | 1410.5 |

| 5 | 2023Q1 | Resale | 5 | 23 | 208 | 1258.5 |

| 6 | 2023Q1 | New Sale | 1 | 10 | 202 | 2942.5 |

| 7 | 2023Q1 | New Sale | 2 | 23 | 178 | 2071.5 |

| 8 | 2023Q1 | New Sale | 3 | 18 | 168 | 1390.0 |

| 9 | 2023Q1 | New Sale | 4 | 16 | 165 | 2084.0 |

| 10 | 2023Q1 | New Sale | 5 | 09 | 150 | 2846.0 |

| 11 | 2023Q1 | Sub Sale | 1 | 19 | 54 | 1635.5 |

| 12 | 2023Q1 | Sub Sale | 2 | 14 | 34 | 2096.5 |

| 13 | 2023Q1 | Sub Sale | 3 | 13 | 27 | 1913.0 |

| 14 | 2023Q1 | Sub Sale | 4 | 18 | 24 | 1598.0 |

| 15 | 2023Q1 | Sub Sale | 5 | 05 | 19 | 1912.0 |

| 16 | 2024Q1 | New Sale | 1 | 23 | 576 | 1542.0 |

| 17 | 2024Q1 | New Sale | 2 | 26 | 571 | 2253.0 |

| 18 | 2024Q1 | Resale | 1 | 19 | 429 | 1448.0 |

| 19 | 2024Q1 | Resale | 2 | 15 | 243 | 1719.0 |

| 20 | 2024Q1 | Resale | 3 | 10 | 236 | 2171.5 |

| 21 | 2024Q1 | Resale | 4 | 23 | 209 | 1361.0 |

| 22 | 2024Q1 | Resale | 5 | 18 | 182 | 1350.0 |

| 23 | 2024Q1 | Sub Sale | 1 | 19 | 94 | 1771.5 |

| 24 | 2024Q1 | New Sale | 3 | 15 | 72 | 2615.5 |

| 25 | 2024Q1 | New Sale | 4 | 21 | 57 | 2453.0 |

| 26 | 2024Q1 | New Sale | 5 | 27 | 56 | 1328.0 |

| 27 | 2024Q1 | Sub Sale | 2 | 05 | 53 | 2061.0 |

| 28 | 2024Q1 | Sub Sale | 3 | 18 | 49 | 1694.0 |

| 29 | 2024Q1 | Sub Sale | 4 | 13 | 20 | 2044.0 |

| 30 | 2024Q1 | Sub Sale | 5 | 14 | 14 | 2051.5 |

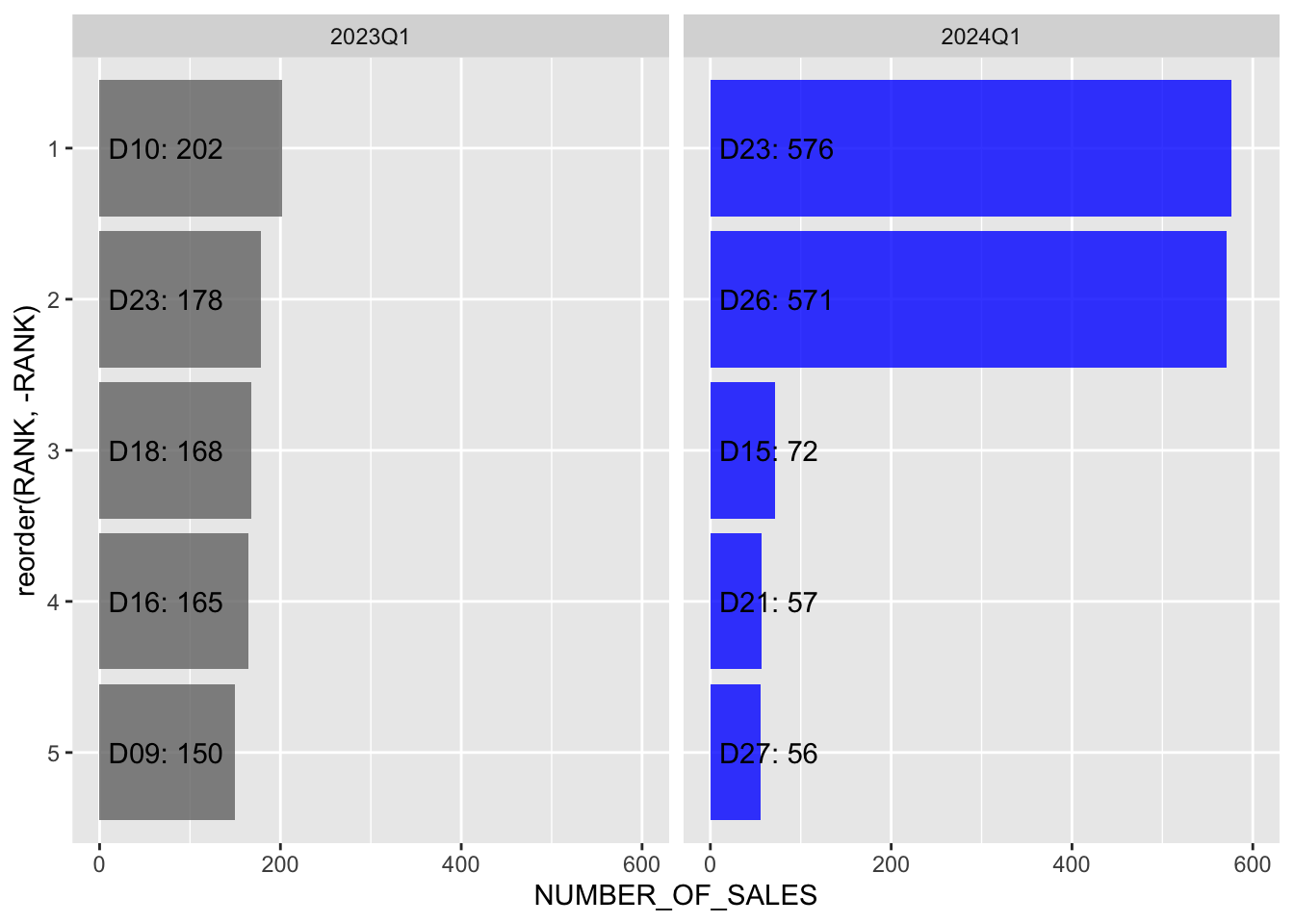

Now that we have this aggregated dataset, we can use this to plot the ranked data. For example, we can plot the most popular districts in the New Sales Market.

ggplot(popular_districts %>% filter(TYPE_OF_SALE =="New Sale"),

aes(x = reorder(RANK, -RANK), y = NUMBER_OF_SALES, fill = QUARTER))+

geom_bar(stat="identity", position = "dodge", show.legend = FALSE, alpha =0.8) +

geom_text(aes(y = 10, hjust=0, label=paste0("D", POSTAL_DISTRICT, ": ", NUMBER_OF_SALES))) +

coord_flip(ylim= c(0, 600)) +

scale_fill_manual(values = c("grey45", "blue")) +

facet_wrap(~QUARTER)

With this visualization, we can compare the top districts from 2 quarters side by side.

From the 2 options, plotting the Most Popular Districts is more appropriate for our use case. This is because we would like the user to recognize which districts are driving the price trends.

When we plot all the districts, it is more difficult to identify by sight which districts are popular in a quarter and the other. This is because this plot has a lot of noise, which may not be that relevant to connect to the previous visualization.

4.3.3 Generating the visualization

We will generate the visualization such that QUARTER is in column and TYPE_OF_SALE is in rows.

We will using facet_grid() to generate the visualization and adjust the theme elements as needed to make the plot more presentable.

Show ggplot2 code

viz2 <- ggplot(popular_districts,

aes(

# Order the axis elements by rank

x = reorder(RANK,-RANK),

y = NUMBER_OF_SALES,

fill = QUARTER

)) +

# Generate bar graph based on number of sales

geom_bar(

stat = "identity",

position = "dodge",

show.legend = FALSE,

alpha = 0.8

) +

# Add descriptive label

geom_text(aes(

y = 10,

hjust = 0,

label = sprintf(

"D%s: %d units sold at S$%0.2f psf",

POSTAL_DISTRICT,

NUMBER_OF_SALES,

MEDIAN_PRICE_PSF

)

), family = "Roboto Condensed") +

# Generate horizontal bar

coord_flip(ylim = c(0, 600)) +

# Set colors consistent with previous visualization

scale_fill_manual(values = c("grey45", "blue")) +

# Generate facets, with labels to the left and at the bottom

facet_grid(TYPE_OF_SALE ~ QUARTER, switch = "both") +

# Set plot texts

plot_annotation(title = "Districts With Highest Units Sold for Each Submarket",

subtitle = "New Sale Market is heavily influenced by the newly-launched projects in **D23** (Lumina Grand) and **D26** (Lentor Mansion).",

caption = "Prices shown are **median unit price** per sqft") &

# Set theme

theme_minimal() +

theme(

text = element_text(family = "Roboto Condensed"),

axis.line.x = element_line(),

axis.title.x = element_blank(),

axis.title.y = element_blank(),

axis.text.y = element_blank(),

plot.title = element_text(face = "bold"),

# Use element_markdown so we can style the text

plot.subtitle = element_markdown(color = "grey50", size = rel(0.9)),

plot.caption = element_markdown(color = "grey50"),

strip.placement = "outside",

strip.text = element_text(size = rel(1))

)

viz2

Texts such as xx units sold at $xxxx.xx were added in the plot so the information is easily digestible.

However, it made the plot messy, and not aesthetically pleasing. Ideally, the full text should be rendered when interacting with the graph. I do not know how to do that right now, but it will be how I will present this visualization in the future.

Given this limit in my present abilities, I prioritized clarity of information over aesthetic considerations.

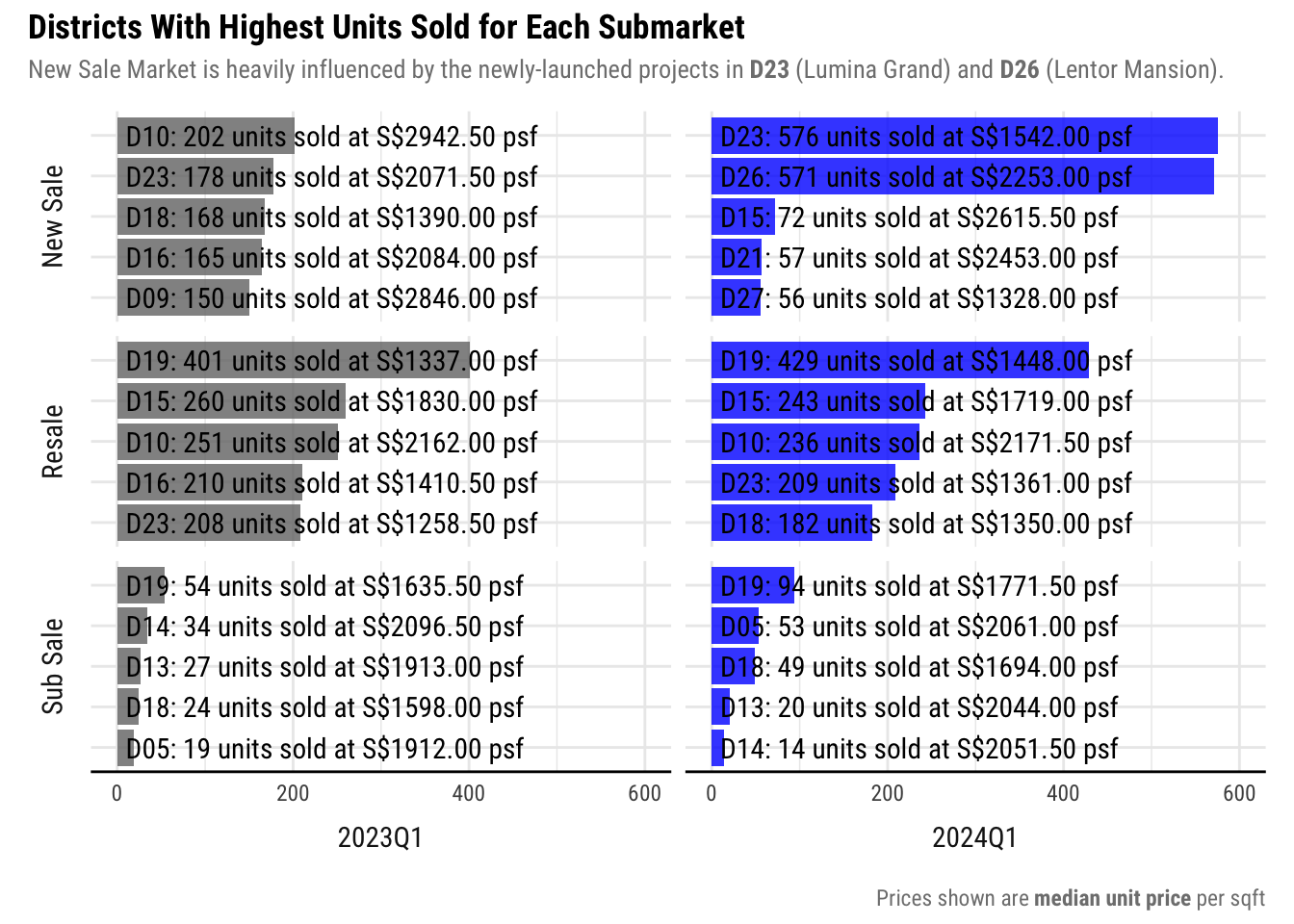

Plotting the most popular districts for each submarket reveals that the Top 5 districts in the New Sale market, differs for the 2 quarters.

In 2023Q1, the distribution is more balanced and there were a lot of units sold in expensive districts like Districts 9 and 10. However, In 2024Q1, the number of units sold were skewed towards cheaper districts like Districts 23 and 26 where big projects like Lumina Grand and Lentor Mansion, respectively, were launched.

This is why the overall prices in the New Sale market appear to be much cheaper than the previous year, when in fact the new projects that launched are in cheaper districts.

On the contrary, the top districts in the Resale and Sub Sale markets have much less difference. This smaller change also resulted in a smaller impact on the overall median price in these markets.

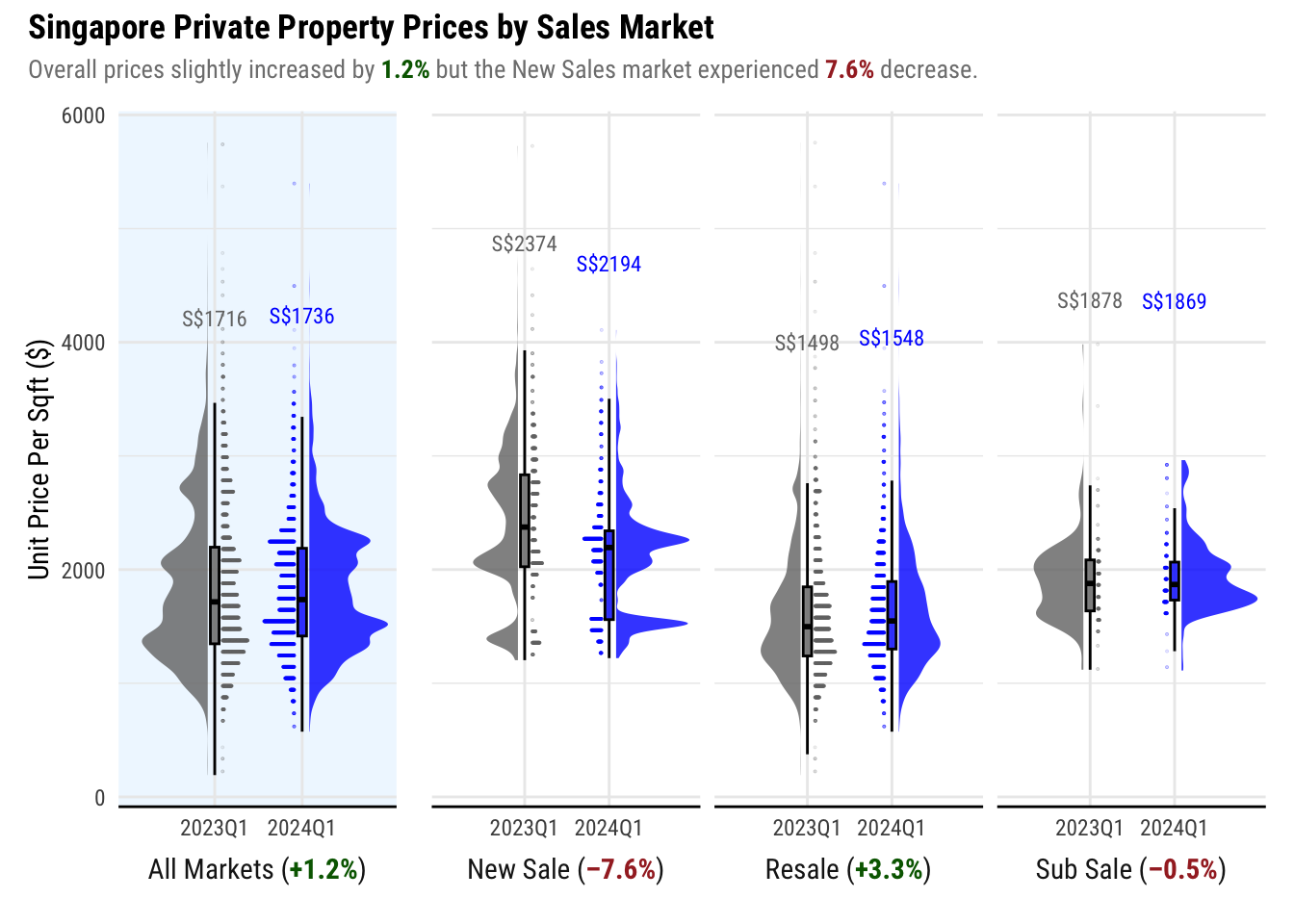

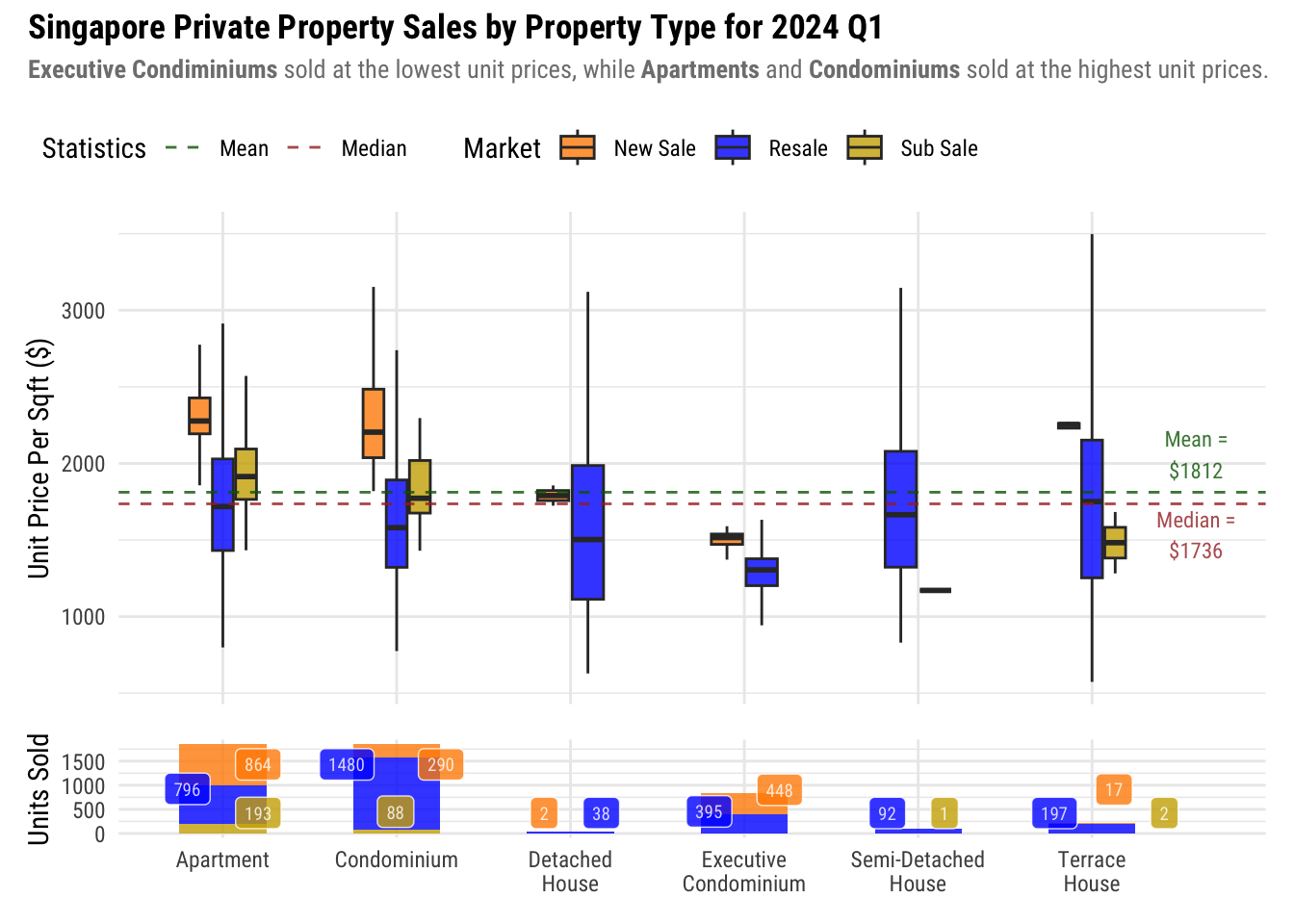

4.4 Visualization 3: 2024 Q1 Market by Property Type

4.4.1 Checking price trends by property type

Previous visualizations focused on comparisons between the Q1 of 2023 and 2024, and based on the different markets.

For the next visualization, we will first explore the data with 2024Q1, based on the property type.

Let us group the data by TYPE_OF_SALE and PROPERTY_TYPE if we can gain new insights based on the size of property. We will get the aggregated median values for price and area columns.

sales_txns_q1_24 %>%

group_by(TYPE_OF_SALE, PROPERTY_TYPE) %>%

summarize(

UNIT_PRICE_PSF = median(UNIT_PRICE_PSF),

TRANSACTED_PRICE = median(TRANSACTED_PRICE),

AREA_SQFT = median(AREA_SQFT),

UNITS_SOLD = n()

) %>% arrange(desc(UNITS_SOLD), .by_group = TRUE) %>%

kable| TYPE_OF_SALE | PROPERTY_TYPE | UNIT_PRICE_PSF | TRANSACTED_PRICE | AREA_SQFT | UNITS_SOLD |

|---|---|---|---|---|---|

| New Sale | Apartment | 2277.0 | 1908500 | 796.540 | 864 |

| New Sale | Executive Condominium | 1516.0 | 1515000 | 995.670 | 448 |

| New Sale | Condominium | 2204.0 | 2083000 | 990.290 | 290 |

| New Sale | Terrace House | 2254.0 | 3655000 | 1614.600 | 17 |

| New Sale | Detached House | 1790.0 | 11690000 | 6607.855 | 2 |

| Resale | Condominium | 1580.5 | 1660000 | 1119.460 | 1480 |

| Resale | Apartment | 1718.5 | 1460000 | 893.410 | 796 |

| Resale | Executive Condominium | 1305.0 | 1375000 | 1076.400 | 395 |

| Resale | Terrace House | 1751.0 | 3750000 | 2055.920 | 197 |

| Resale | Semi-Detached House | 1665.0 | 5642500 | 3459.010 | 92 |

| Resale | Detached House | 1503.0 | 10940000 | 7004.130 | 38 |

| Sub Sale | Apartment | 1914.0 | 1473000 | 721.190 | 193 |

| Sub Sale | Condominium | 1772.5 | 1525000 | 742.720 | 88 |

| Sub Sale | Terrace House | 1482.5 | 3229000 | 2195.855 | 2 |

| Sub Sale | Semi-Detached House | 1171.0 | 4750000 | 4058.030 | 1 |

From this aggregated data, we can see that Executive Condominiums are relatively cheaper than Condominiums and Apartments, which are of similar area. From my research, Executive Condominiums are under HDB, but are built and sold by property developers. This is why it is much cheaper.

We can also notice that there are much lower sales for some property types, like Terrace House, Semi-Detached House, and Detached House. These are landed properties, which are quite rare in Singapore so it is logical to see much fewer sales of these properties.

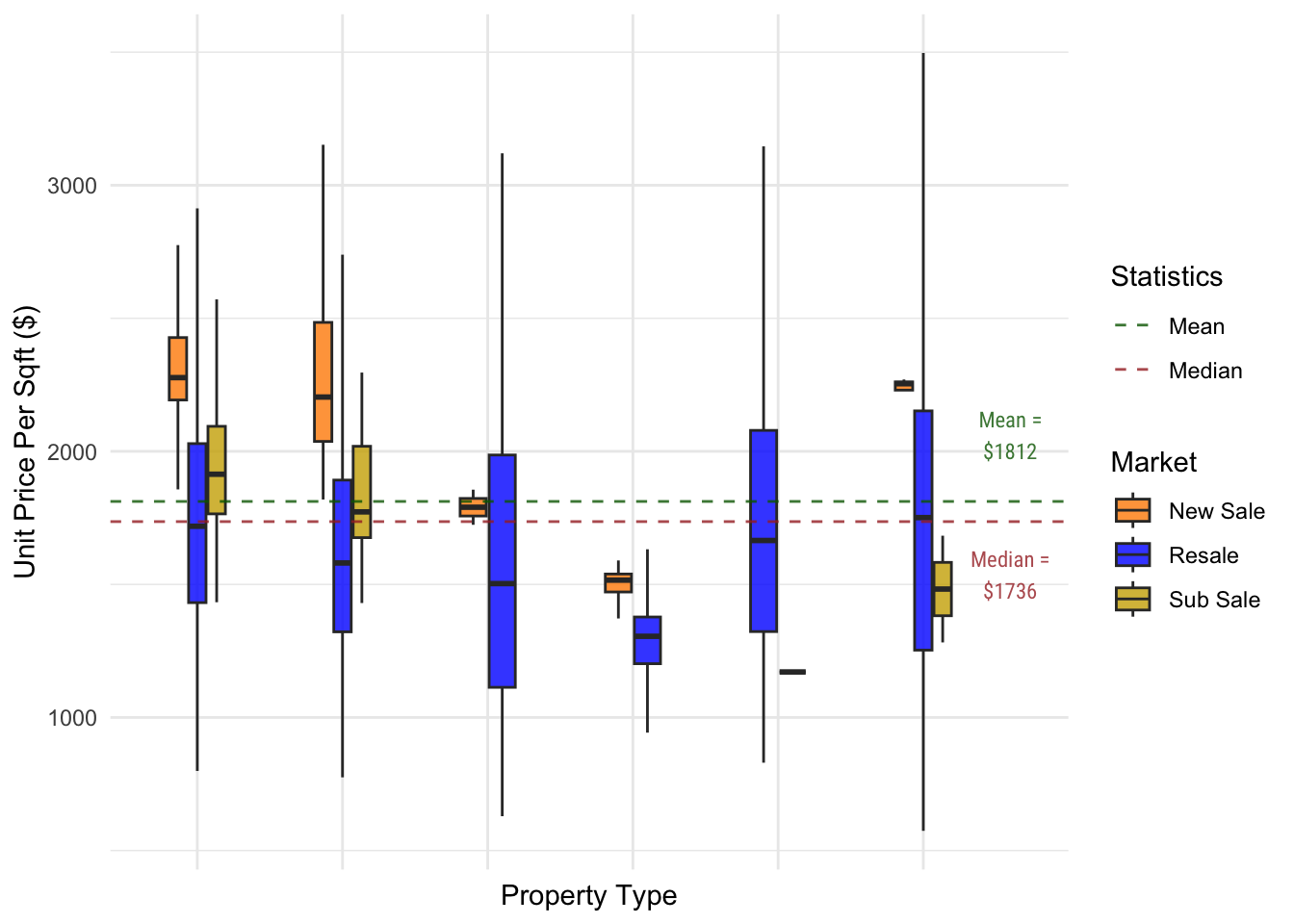

4.4.2 Creating base visualizations

From the insights gained from our initial exploration, we observed that prices differ by property types and that there are less sales on some property prices.

For the unit price, we will use boxplot instead of density plots as we can see the distribution for different markets. If we use density plots, it is harder to present partitioned data in an easy to understand way.

Lastly, we will generate some reference lines for statistics (mean and median).

Show ggplot2 code

# Calculate stats for reference lines

median_q1 <- median(sales_txns_q1_24$UNIT_PRICE_PSF)

mean_q1 <- mean(sales_txns_q1_24$UNIT_PRICE_PSF)

unit_price_by_prop_type <- ggplot(sales_txns_q1_24,

aes(x = PROPERTY_TYPE, y = UNIT_PRICE_PSF, fill = TYPE_OF_SALE)) +

# Generate different boxplots for each market and property type

geom_boxplot(outliers = FALSE,

width = 0.4,

alpha = 0.8) +

# Render median reference line

geom_hline(aes(yintercept = median_q1, color = "Median"),

linetype = "dashed",

alpha = 0.8) +

annotate(

geom = "text",

x = 6.6,

y = ifelse(median_q1 < mean_q1, median_q1 - 200, median_q1 + 250),

label = paste0("Median =\n$", median_q1),

family = "Roboto Condensed",

color = "brown",

size = 3,

alpha = 0.8

) +

# Render mean reference line

geom_hline(aes(yintercept = mean_q1, color = "Mean"),

linetype = "dashed",

alpha = 0.8) +

annotate(

geom = "text",

x = 6.6,

y = ifelse(mean_q1 < median_q1, mean_q1 - 200, mean_q1 + 250),

label = paste0("Mean =\n$", round(mean_q1, 0)),

family = "Roboto Condensed",

color = "darkgreen",

size = 3,

alpha = 0.8

) +

# Set labels

labs(x = "Property Type",

y = "Unit Price Per Sqft ($)",

fill = "Market",

color = "Statistics") +

# Wrap long labels using `wrap_format()` from `scale` package

# Add some space to the right for Statistics annotations

scale_x_discrete(labels = wrap_format(10), expand = expansion(add = c(0.6, 1))) +

# Set colors

scale_fill_manual(values = c("darkorange", "blue", "gold3")) +

scale_color_manual(values = c("darkgreen", "brown")) +

theme_minimal() +

theme(

# Remove axis text. Combining this with the price visualization will stack the 2 graphs

axis.text.x = element_blank()

)

unit_price_by_prop_type

We can see from the graph that some box plots are very short, which is especially true for Landed properties as there are few units sold for these property types.

As companion to the unit price graph, we will also generate a simple bar graph for the volume.

Show ggplot2 code

sales_volume_by_prop_type <-

ggplot(

sales_txns_q1_24,

aes(x = PROPERTY_TYPE, fill = TYPE_OF_SALE)

) +

# Generate stacked bar graph by TYPE_OF_SALE

# Do not show label as the price graph will show it

geom_bar(alpha = 0.8, width = 0.5, show.legend = FALSE) +

# Generate labels for stacked bar areas

# Do not show label as the price graph will show it

# Use ggrepel as some areas in the bar graph are too small to render th text inside

geom_label_repel(

aes(label = after_stat(count)),

stat = "count",

position = "stack",

family = "Roboto Condensed",

size = 2.5,

alpha = 0.8,

color = "white",

show.legend = FALSE

) +

# Apply colors

scale_fill_manual(values = c("darkorange", "blue", "gold3")) +

labs(y = "Units Sold") +

# Wrap long titles

# Apply same "expand" so axes align

scale_x_discrete(labels = wrap_format(10), expand = expansion(add = c(0.6, 1))) +

# Appply theme

theme_minimal() +

theme()

sales_volume_by_prop_type

The volume graph provides additional information about sales by property type. Some property types with lower sales volume may show a longer boxplot, which may be interpreted as more units sold.

With this companion graph, it is easier to cross-reference the price with the volume to better judge how representative of the market the unit prices are.

4.4.3 Generating the visualization

Finally, we will generate the visualization by stacking the 2 graphs and doing final touches on the styling and texts.

Show ggplot2 code

viz3 <- (unit_price_by_prop_type / sales_volume_by_prop_type ) +

plot_layout(heights = c(5,1)) +

plot_annotation(title = "Singapore Private Property Sales by Property Type for 2024 Q1",

subtitle = "**Executive Condiminiums** sold at the lowest unit prices, while **Apartments** and **Condominiums** sold at the highest unit prices.") &

theme(

text = element_text(family = "Roboto Condensed"),

axis.title.x = element_blank(),

legend.position = "top",

legend.justification = "left",

legend.location = "plot",

plot.title = element_text(face = "bold"),

plot.subtitle = element_markdown(color = "grey50", size = rel(0.9)),

)

viz3

From our initial exploration, we have already established that Executive Condominiums are cheapest in terms of unit price.

Another surprising observation is that despite having more Executive Condominiums sold, its boxplot is notably shorter compared to Detached and Semi-Detached Houses, in both the New Sale and Resale Markets. This disparity may be attributed to HDB’s price regulation on Executive Condominiums, resulting in reduced price variability compared to other property types.

It can also be observed that there are much fewer sales in the New Sales market of landed properties. It could be due to the fact that compared to Strata developments, Landed properties are usually bespoke to their owner’s use. In addition to the fact that landed properties are rare in Singapore, is it expected to see less New Sales in this category.

Lastly, the mean is higher than the median price which means that the unit prices are skewed towards the higher end of the scale. What this means it that prices tend to be more expensive than cheaper.

5 Summary

5.1 Visualizations

For this exercise, we generated 3 visualizations, show below.

5.1.1 Singapore Private Property Prices by Sales Market

5.1.2 Districts with Highest Units Sold for Each Submarket

5.1.3 Singapore Private Property Sales by Property Type for 2024 Q1

5.2 Overall Insights

We found that the 2024 New Sales market experienced an sizable decrease is overall prices (7.6%) compared to the same period last year. However, it should be noted that this is due to New Launches located in cheaper districts, compared to the same period last year where that launches where in central districts like 9 and 10.

Another very interesting insight is that different property prices experience big variations in prices, while Executive Condominiums have smaller variations. This is because of the more controlled and regulated environment as these properties are under the jurisdiction of HDB. This is why although median prices are at S$1736 in 2024Q1, it is possible to find a more affordable property when looking at Executive Condominiums.

Hence, a prospective buyer must take generalizations in the housing market with the grain of salt as overall market trends may not reflect the situation in the market they are interested in. This is why when thinking of buying a property, it is important to be more specific on the kind of property you are looking for (e.g. which district, property type, new or resale, etc) and narrow down on the trends for each of those. They must do their own due diligence in researching the market they are interested in to make a sound decision on their purchase.

5.3 Reflections

When choosing how to visualize the data, I had to make hard decisions on what data subsets to select. At first I was wary that I will be presenting misleading data. My own bias and limitations also reflect the output as I had to limit myself to looking at 2 quarters as I cannot imagine how to present data from all 5 quarters effectively with the level of detail in the different submarkets and property type.

However, I realized that with the details available to us, it is impossible to cover everything. It is more important to tailor the visualization to our target audience, and even then we may not be able to provide everything they need.

I am now more aware that as a data visualization consumer, I must do my on due diligence to dive deep into the details as the visualizations may be too general or too detailed for our own needs. Some data may be omitted or data due to various limitations.

As a student, there were also some frustrating moments as I wanted to present data in a certain way but my current abilities limit me from presenting data in such a way (especially on Visualization 2). As I progress in this course, I will challenge myself to implement those ideas as I expand my own learning.

6 References

99.co. (2024). New Launch Condos & Projects in Singapore. 99.co. https://www.99.co/singapore/new-launches

Holtz, Yan. (2024). Dealing with colors in ggplot2. The R Graph Gallery. https://r-graph-gallery.com/ggplot2-color.html

Housing & Development Board. (2024). Executive Condominium. Housing & Development Board. https://www.hdb.gov.sg/residential/buying-a-flat/executive-condominium

Kam, Tin Seong. (2023). Visualising Distribution. R for Visual Analytics. https://r4va.netlify.app/chap09

Lim, Abram. (2024). 13+ Housing & Household Statistics in Singapore (2024).SmartWealth Singapore. https://smartwealth.sg/housing-household-statistics-singapore/

PropertyGuru Editorial Team. (2024). Singapore Property Market Outlook 2024 Overview. PropertyGuru. https://www.propertyguru.com.sg/property-guides/singapore-property-market-outlook-2024-90041

Tan, Kylie. (2023). Take-home Exercise 1: Investigating Student Performance with Data Visualisations. Kale’s Visual Analytics Tales. https://akalestale.netlify.app/

Trading Economics. (2024). Home Ownership Rate | G20. https://tradingeconomics.com/country-list/home-ownership-rate?continent=g20